Regression Techniques

Deepayan Sarkar

Regression

Most of you should be familiar with Linear Regression / Least Squares

- What is the purpose?

- What are the model assumptions?

Are there any other kinds of regression?

Course: Regression Techniques

- This course is not about linear regression!

We will

Try to refine what we understand by the term “regression” (linear regression is only a special case)

Learn alternative approaches to solve the “regression” problem

Learn how to identify and address modeling errors

Most techniques we will learn require non-trivial programming

We will learn and use the R language for computation

Room 11 (ground floor) is a computer lab (usually locked, but security guards at the main gate will open it when you ask them)

There are two more (smaller) computer labs in teh ground floor of the Faculty Building

You can use your own laptops as well

Evaluation scheme

Midterm examination: 30%

Final examination: 50%

Assignments / Projects: 20%

What is Regression?

Consider bivariate data \((X, Y)\) with some distribution

Interested in “predicting” \(Y\) for a fixed value of \(X=x\)

In probability terms, want the conditional distribution of \[Y | X = x\]

- In general

- \(Y\) could be numeric or categorical

- \(X\) could also be numeric or categorical

The “Regression Problem”: when \(Y\) is numeric

The “Classification Problem”: when \(Y\) is categorical

A more modern approach is to view both as special cases of the “Learning Problem”

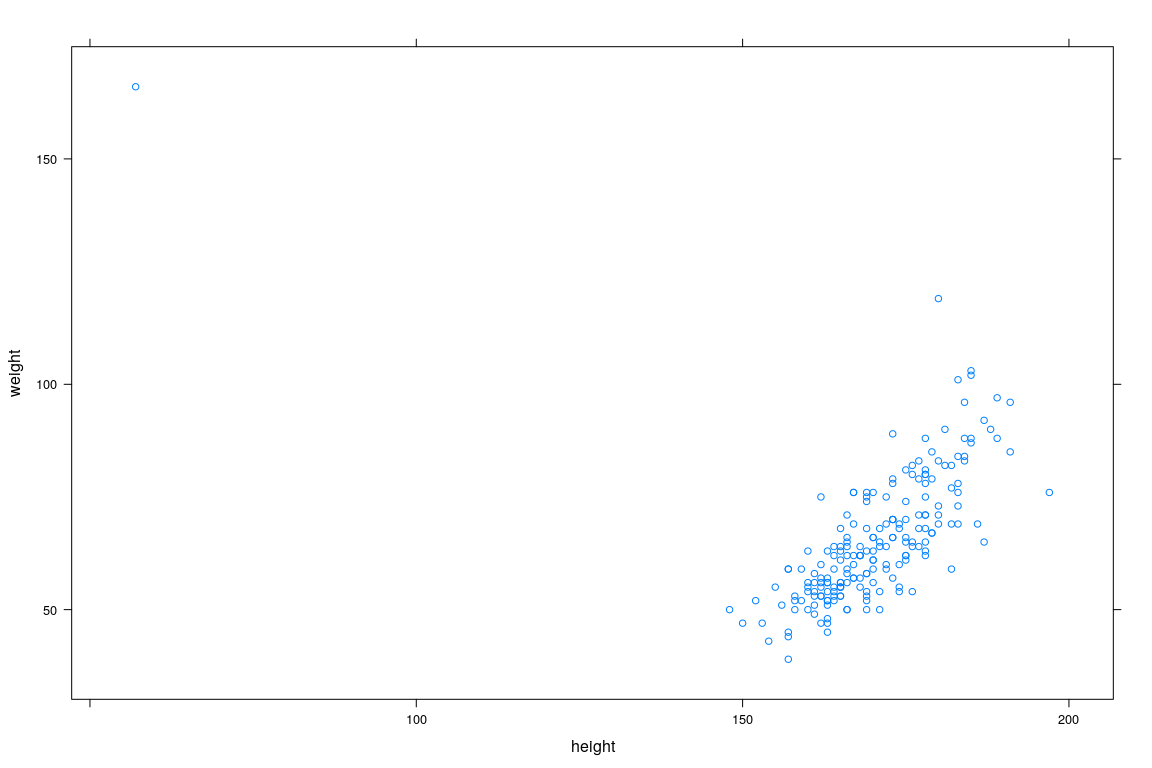

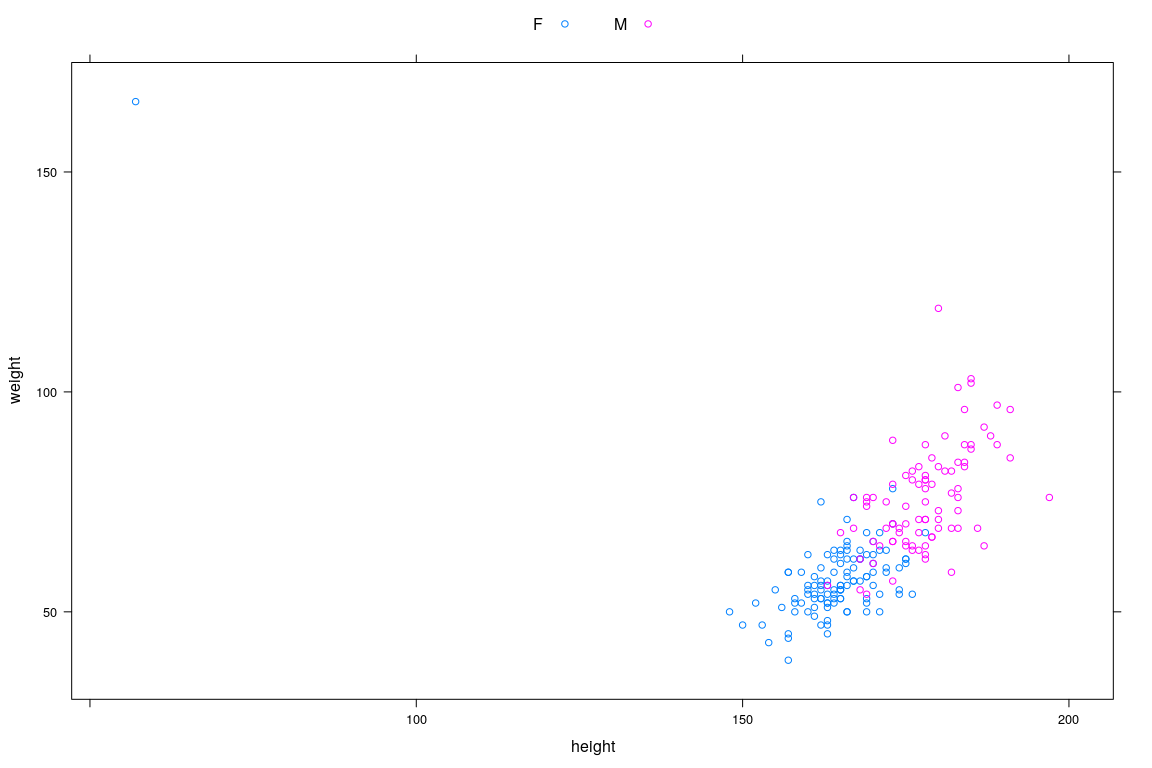

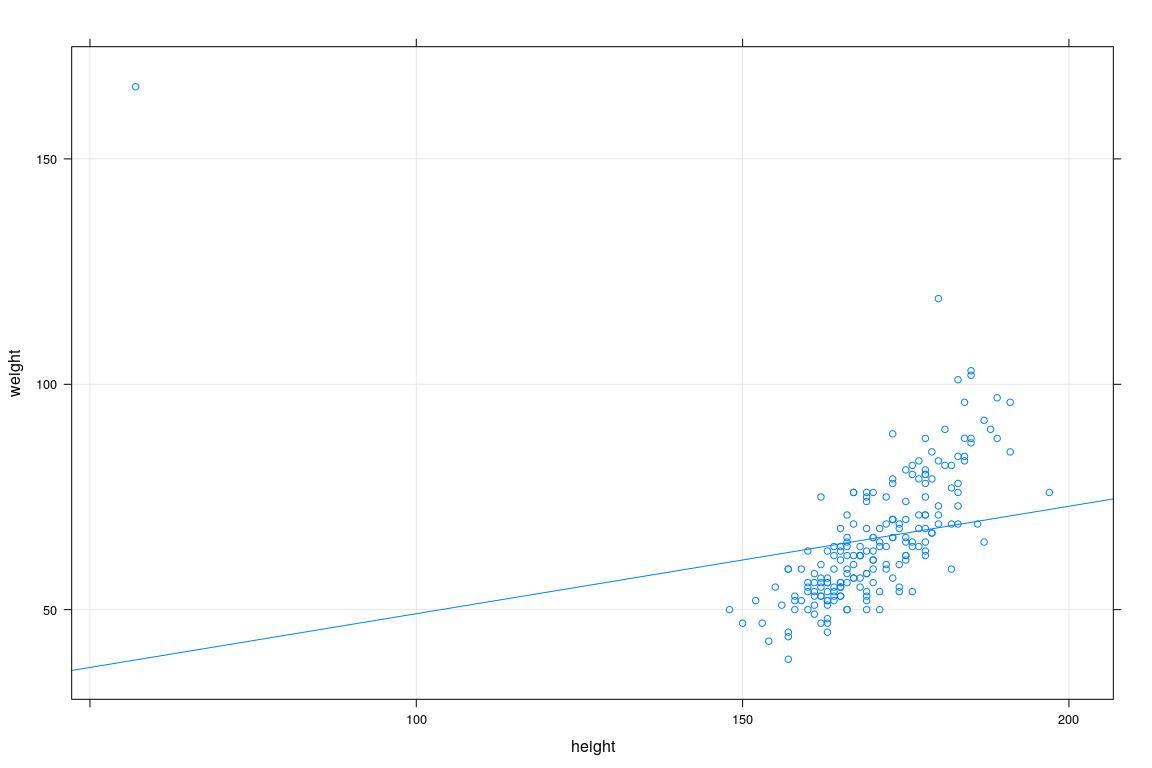

Example: Height and Weight Data

sex weight height repwt repht

1 M 77 182 77 180

2 F 58 161 51 159

3 F 53 161 54 158

4 M 68 177 70 175

5 F 59 157 59 155

6 M 76 170 76 165

7 M 76 167 77 165

8 M 69 186 73 180

9 M 71 178 71 175

10 M 65 171 64 170

11 M 70 175 75 174

12 F 166 57 56 163

13 F 51 161 52 158

14 F 64 168 64 165

15 F 52 163 57 160

16 F 65 166 66 165

17 M 92 187 101 185

18 F 62 168 62 165

19 M 76 197 75 200

20 F 61 175 61 171Interested in predicting weight distribution as a function of height

How should we proceed?

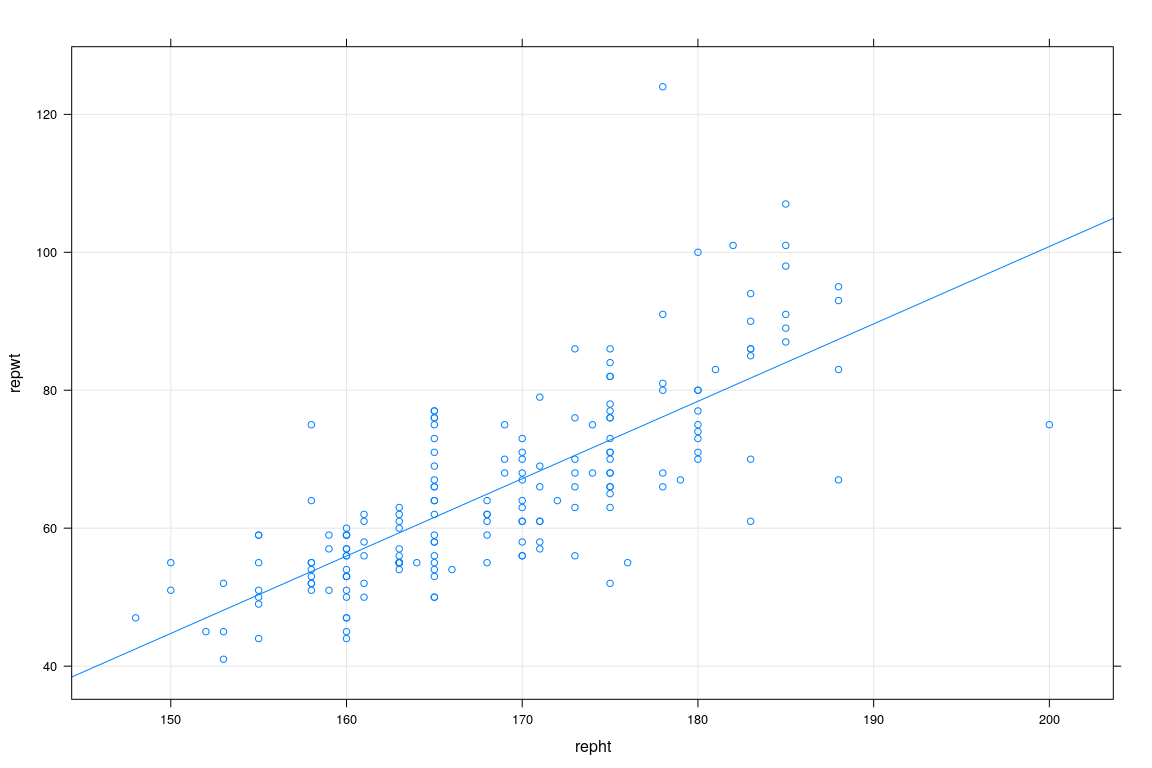

Example: Height and Weight Data

Example: Height and Weight Data

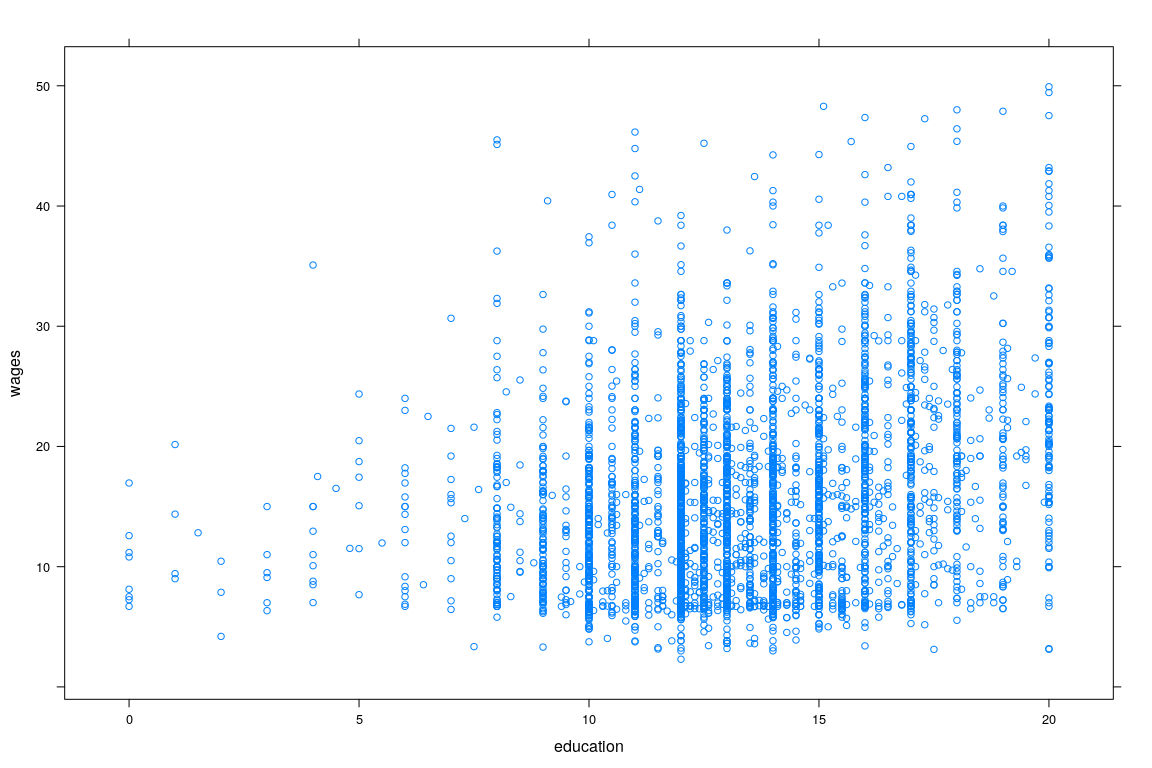

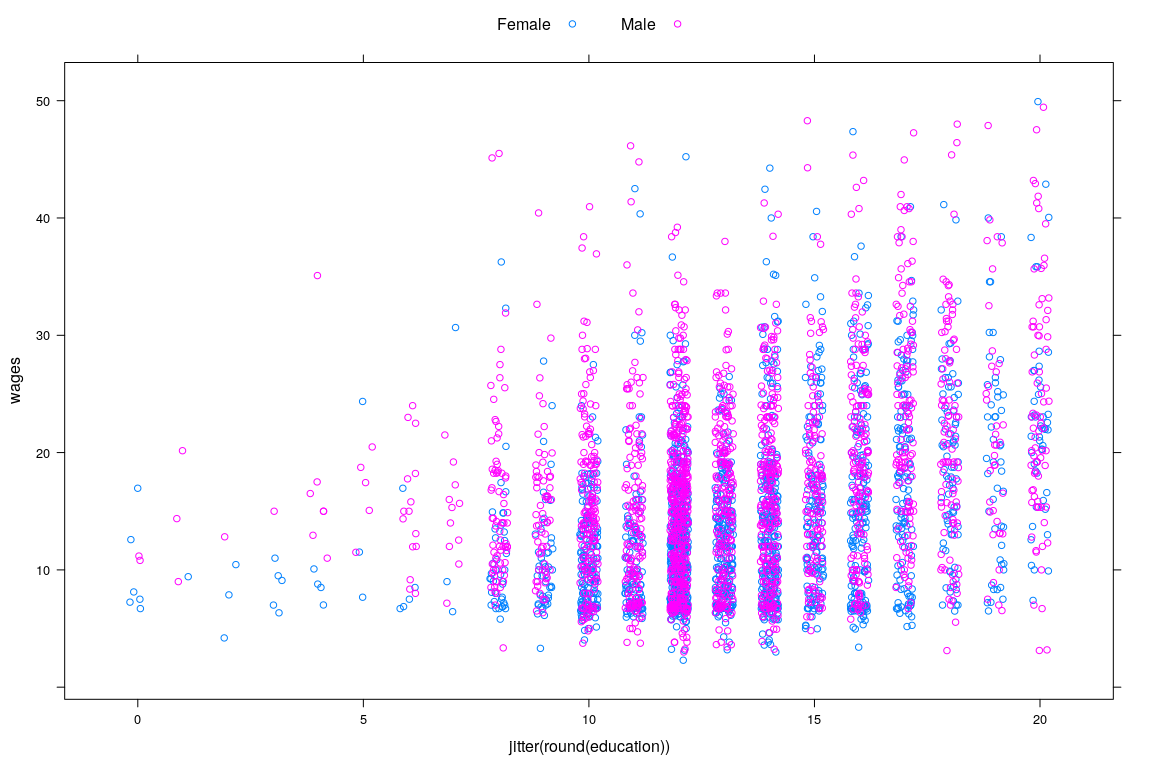

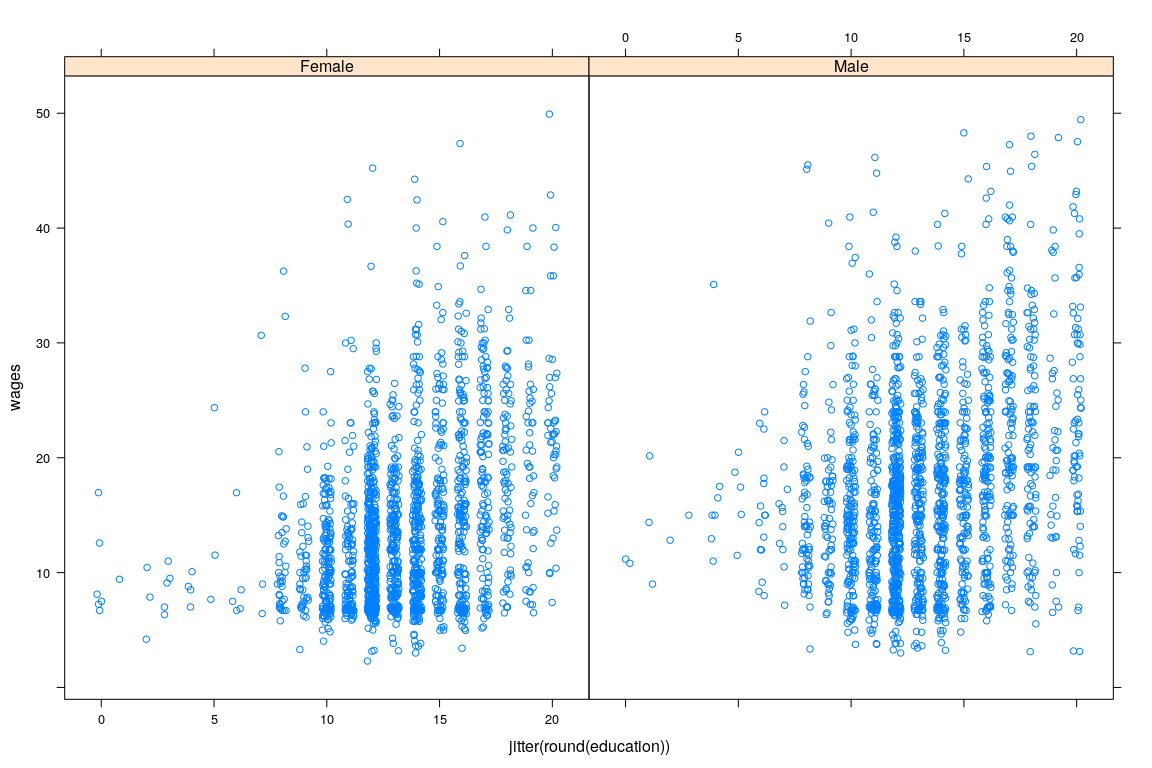

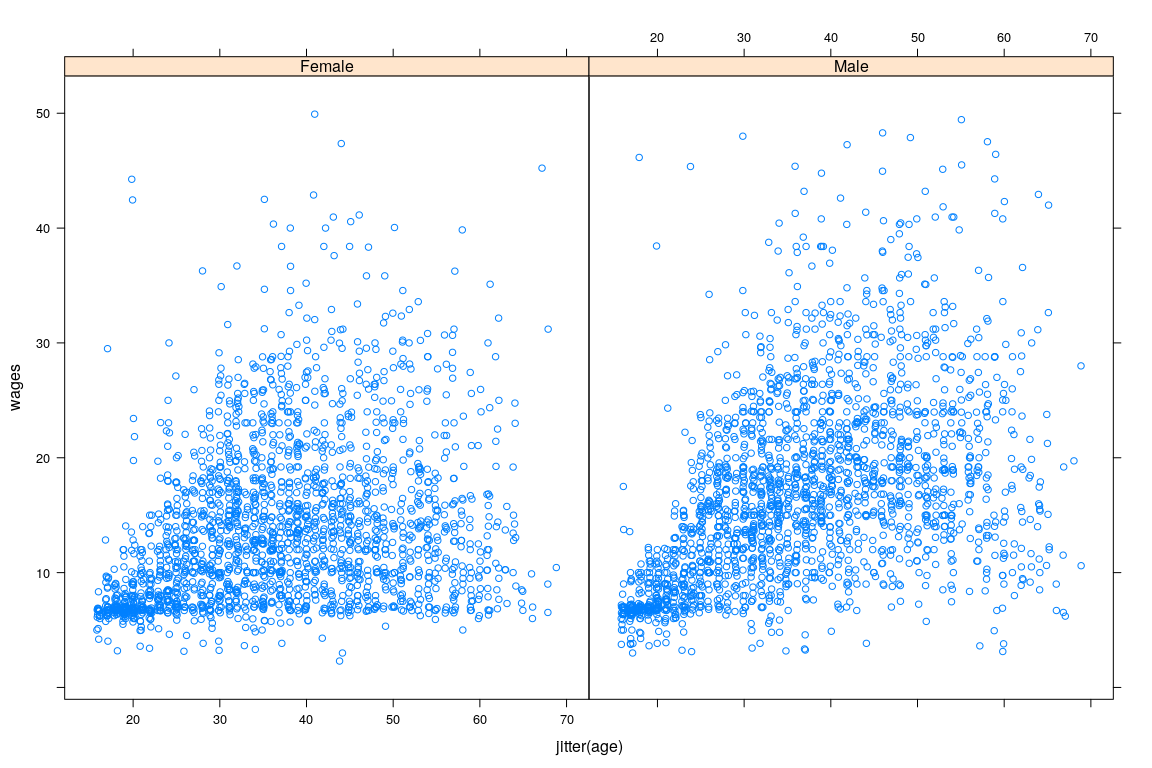

Example: Survey of Labour and Income Dynamics

'data.frame': 7425 obs. of 5 variables:

$ wages : num 10.6 11 NA 17.8 NA ...

$ education: num 15 13.2 16 14 8 16 12 14.5 15 10 ...

$ age : int 40 19 49 46 71 50 70 42 31 56 ...

$ sex : Factor w/ 2 levels "Female","Male": 2 2 2 2 2 1 1 1 2 1 ...

$ language : Factor w/ 3 levels "English","French",..: 1 1 3 3 1 1 1 1 1 1 ... wages education age sex language

1 10.56 15.0 40 Male English

2 11.00 13.2 19 Male English

3 NA 16.0 49 Male Other

4 17.76 14.0 46 Male Other

5 NA 8.0 71 Male English

6 14.00 16.0 50 Female English

7 NA 12.0 70 Female English

8 NA 14.5 42 Female English

9 8.20 15.0 31 Male English

10 NA 10.0 56 Female English- Interested in predicting wage

Example: Survey of Labour and Income Dynamics

Example: Survey of Labour and Income Dynamics

Example: Survey of Labour and Income Dynamics

Example: Survey of Labour and Income Dynamics

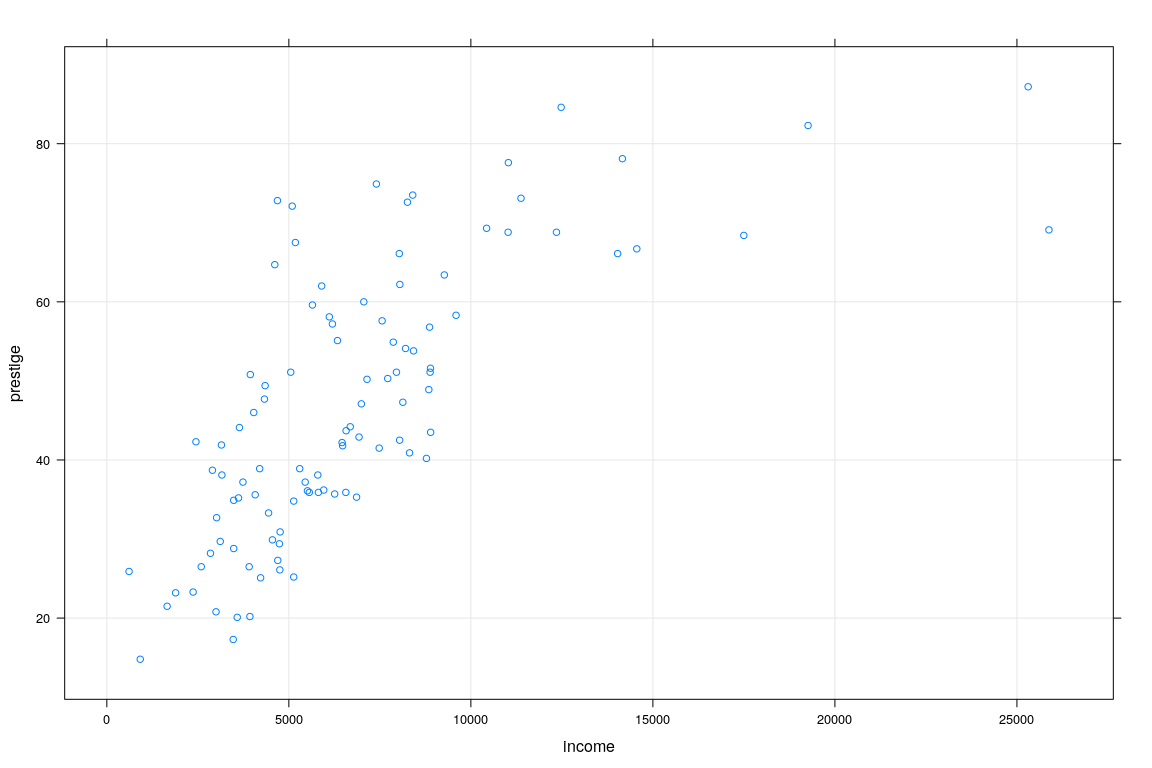

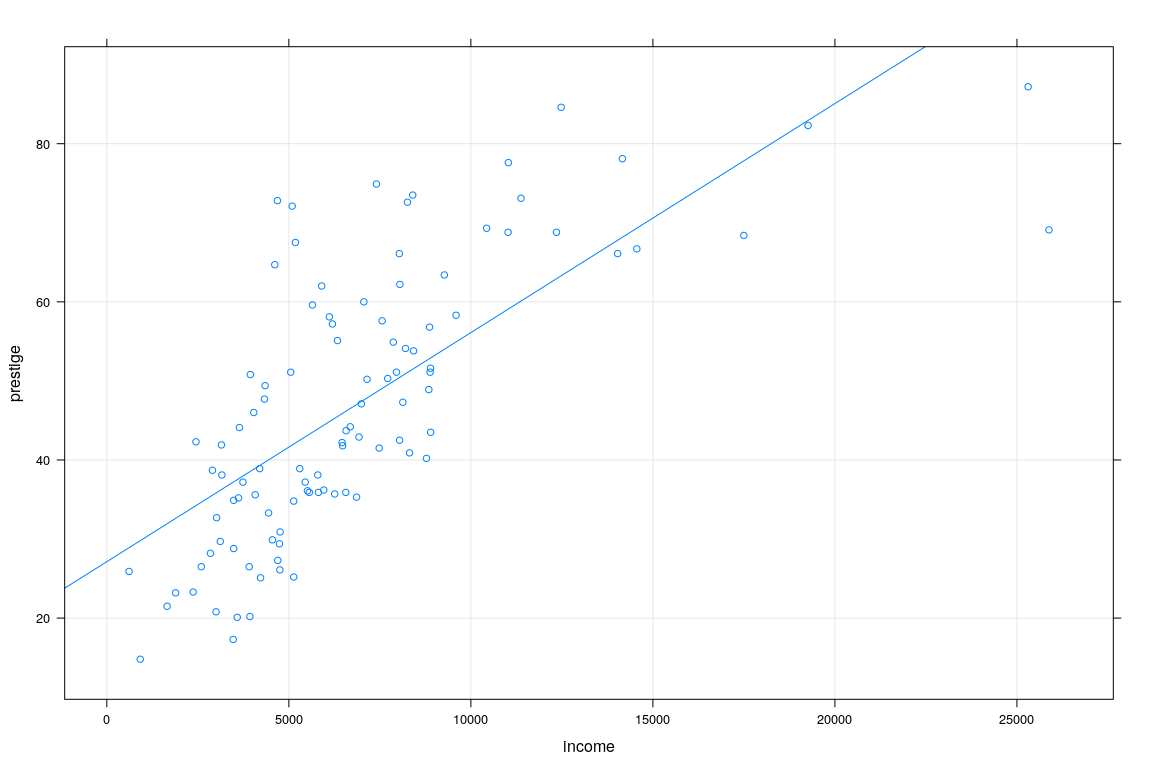

Example: Prestige vs Average income (Canada, 1971)

education income women prestige census type

gov.administrators 13.11 12351 11.16 68.8 1113 prof

general.managers 12.26 25879 4.02 69.1 1130 prof

accountants 12.77 9271 15.70 63.4 1171 prof

purchasing.officers 11.42 8865 9.11 56.8 1175 prof

chemists 14.62 8403 11.68 73.5 2111 prof

physicists 15.64 11030 5.13 77.6 2113 prof

biologists 15.09 8258 25.65 72.6 2133 prof

architects 15.44 14163 2.69 78.1 2141 prof

civil.engineers 14.52 11377 1.03 73.1 2143 prof

mining.engineers 14.64 11023 0.94 68.8 2153 prof

surveyors 12.39 5902 1.91 62.0 2161 prof

draughtsmen 12.30 7059 7.83 60.0 2163 prof

computer.programers 13.83 8425 15.33 53.8 2183 prof

economists 14.44 8049 57.31 62.2 2311 prof

psychologists 14.36 7405 48.28 74.9 2315 prof

social.workers 14.21 6336 54.77 55.1 2331 prof

lawyers 15.77 19263 5.13 82.3 2343 prof

librarians 14.15 6112 77.10 58.1 2351 prof

vocational.counsellors 15.22 9593 34.89 58.3 2391 prof

ministers 14.50 4686 4.14 72.8 2511 profExample: Prestige vs Average income (Canada, 1971)

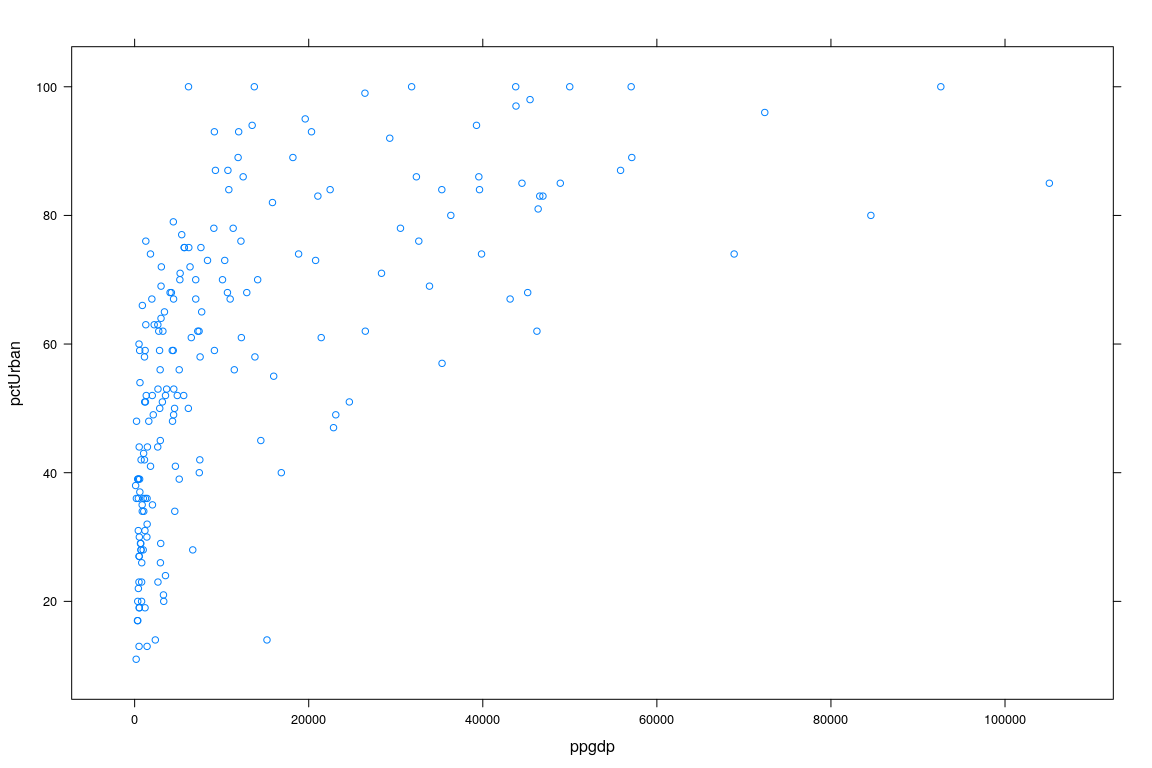

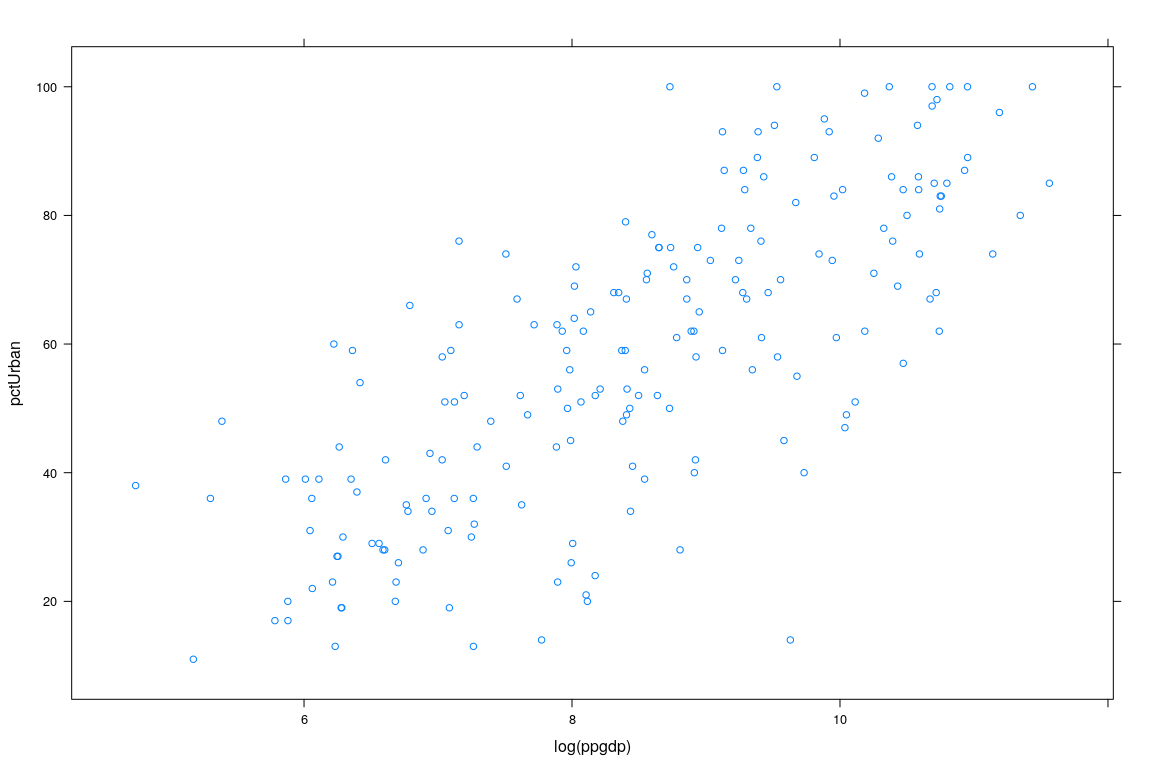

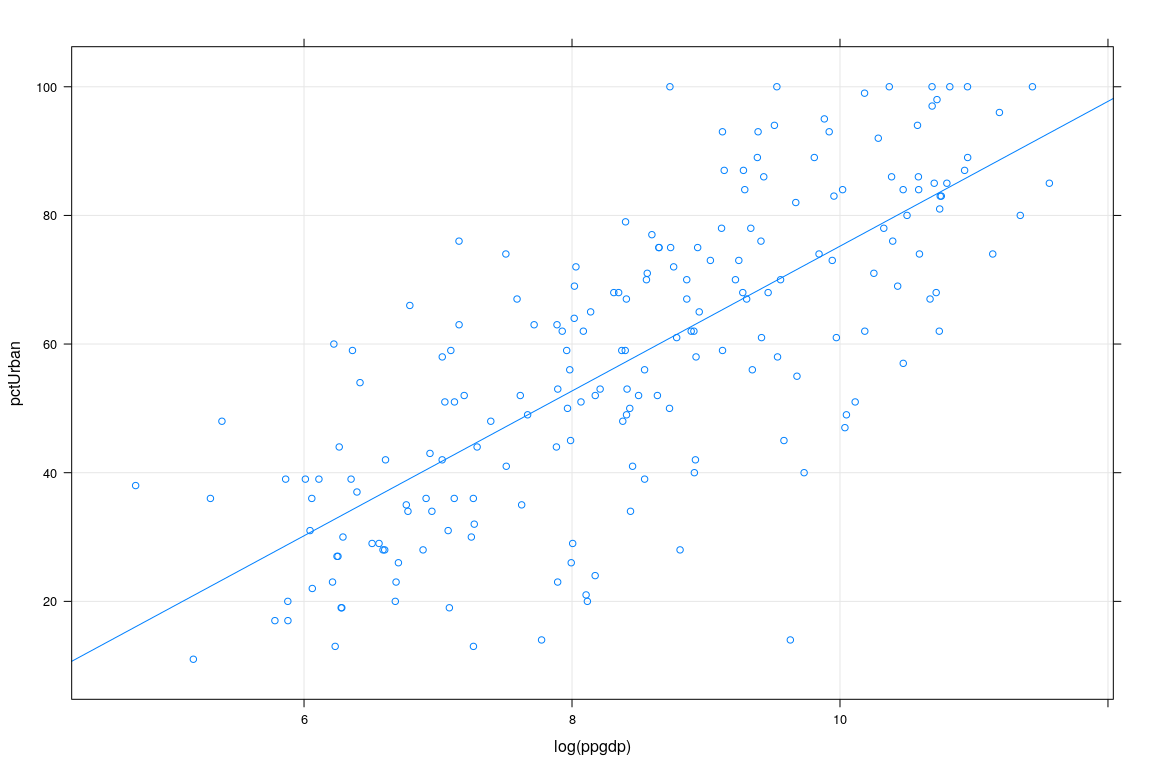

Example: UN National Statistics

region group fertility ppgdp lifeExpF pctUrban infantMortality

Afghanistan Asia other 5.968 499.0 49.49 23 124.53500

Albania Europe other 1.525 3677.2 80.40 53 16.56100

Algeria Africa africa 2.142 4473.0 75.00 67 21.45800

American Samoa <NA> <NA> NA NA NA NA 11.29389

Angola Africa africa 5.135 4321.9 53.17 59 96.19100

Anguilla Caribbean other 2.000 13750.1 81.10 100 NA

Argentina Latin Amer other 2.172 9162.1 79.89 93 12.33700

Armenia Asia other 1.735 3030.7 77.33 64 24.27200

Aruba Caribbean other 1.671 22851.5 77.75 47 14.68700

Australia Oceania oecd 1.949 57118.9 84.27 89 4.45500

Austria Europe oecd 1.346 45158.8 83.55 68 3.71300

Azerbaijan Asia other 2.148 5637.6 73.66 52 37.56600

Bahamas Caribbean other 1.877 22461.6 78.85 84 14.13500

Bahrain Asia other 2.430 18184.1 76.06 89 6.66300

Bangladesh Asia other 2.157 670.4 70.23 29 41.78600

Barbados Caribbean other 1.575 14497.3 80.26 45 12.28400

Belarus Europe other 1.479 5702.0 76.37 75 6.49400

Belgium Europe oecd 1.835 43814.8 82.81 97 3.73900

Belize Latin Amer other 2.679 4495.8 77.81 53 16.20000

Benin Africa africa 5.078 741.1 58.66 42 76.67400- Interested in predicting

pctUrbanusingppgdp

Example: UN Data

Example: UN Data

Review of Linear Regression

Interested in “predicting” \(Y\) for a fixed value of \(X=x\)

In probability terms, want the conditional distribution of \[Y | X = x\]

Important special case: linear regression

Appropriate under certain model assumptions

Essential component in more general procedures

You will learn theory in Linear Model course

We will review basics

Conditional distribution

\[Y | X = x\]

In general, the conditional distribution can be anything

If \((X, Y)\) is jointly Normal, then \[Y | X = x \sim N(\alpha + \beta x, \sigma^2)\]

for some \(\alpha, \beta, \sigma^2\)This is the motivation for Linear Regression

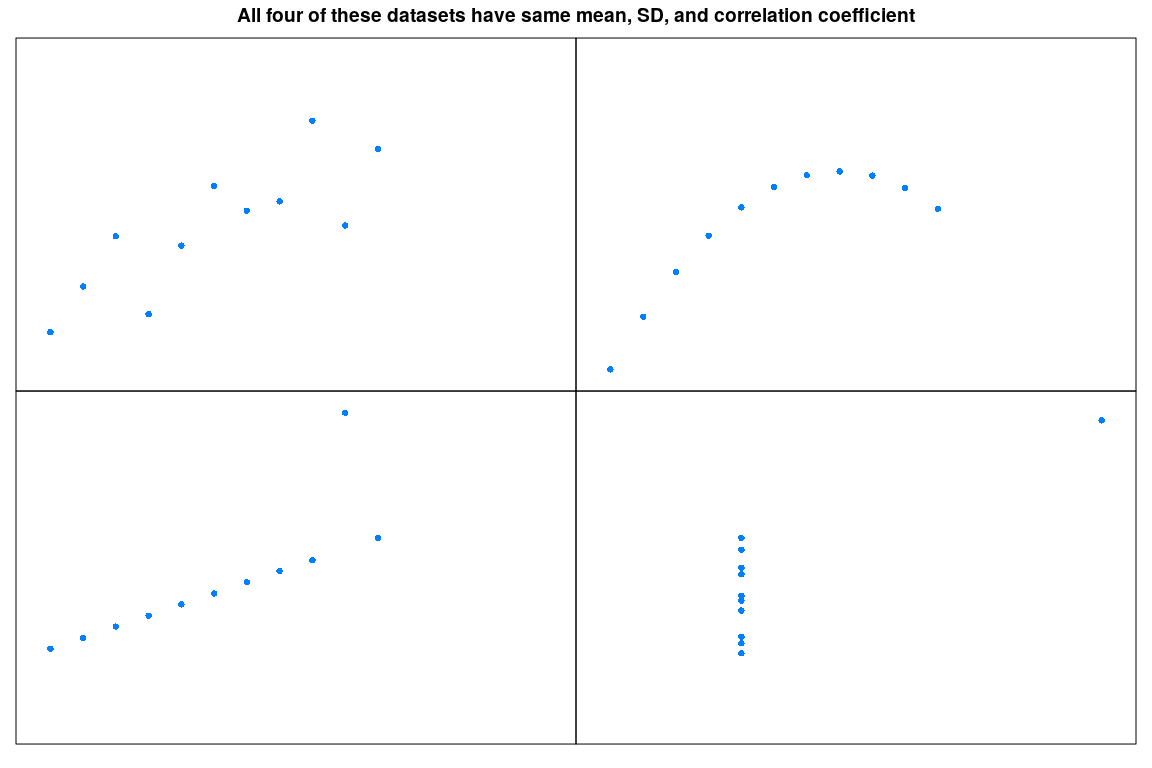

Correlation: Measuring linear dependence

Suppose \(E(X) = \mu_X\) and \(E(Y) = \mu_Y\)

The covariance of \(X\) and \(Y\) is defined by

\[ Cov\left(X,Y\right) = E\bigl( (X-\mu_X ) ( Y-\mu_Y) \bigr) = E(XY) - \mu_X \, \mu_Y \]

The correlation coefficient \(\rho \left( X,Y \right)\) of \(X\) and \(Y\) is defined by

\[ \rho (X,Y)=\frac{Cov\left( X,Y\right) }{\sqrt{Var \left( X\right) Var\left( Y\right) }} \]

Properties of Correlation Coefficient

\(-1 \leq \rho \leq 1\)

\(\rho = -1\): perfect decreasing linear relation

\(\rho = 1\): perfect increasing linear relation

\(\rho = 0\): no linear relation

Sample Correlation

Sample analog of correlation

\[ r(X,Y)=\frac{\sum_i (x_i - \bar x) (y_i - \bar y)} {\sqrt{ \sum_i (x_i - \bar x)^2 \sum_i (y_i - \bar y)^2 }} \]

Closely related with regression

Correlation between height and weight (

Davisdata): 0.19Correlation between reported height and weight (

Davisdata): 0.762Correlations in labour dynamics data

| wages | education | age | |

|---|---|---|---|

| wages | 1.000 | 0.307 | 0.361 |

| education | 0.307 | 1.000 | -0.298 |

| age | 0.361 | -0.298 | 1.000 |

Warning! Correlation only measures linear relation!

(Multiple) Linear Regression

In general form, the regression model assumes

\[ E(Y | X_1 = x_1, X_2 = x_2, \dotsc, X_p = x_p) = \beta_0 + \sum_{j=1}^p \beta_j x_j \] \[ Var(Y | X_1 = x_1, X_2 = x_2, \dotsc, X_p = x_p) = \sigma^2 \]

where

\(\beta_0, \beta_1, \dotsc, \beta_p, \sigma^2 > 0\) are unknown parameters

\(X_1, X_2, \dotsc, X_p\) are (conditionally) fixed covariates

\(X_1, X_2, \dotsc, X_p\) may be derived from a smaller set of predictors, e.g.,

- \(X_2 = Z_1\) (linear term for \(Z_1\))

- \(X_3 = Z_2\) (linear term for \(Z_2\))

- \(X_4 = Z_1^2\) (quadratic term for \(Z_1\))

- \(X_5 = Z_2^2\) (quadratic term for \(Z_2\))

- \(X_6 = Z_1 Z_2\) (interaction term)

(Multiple) Linear Regression

In vector notation (incorporating intercept term in \(\mathbf{X}\))

\[ E(Y | \mathbf{X} = \mathbf{x}) = \mathbf{x}^T \mathbf{\beta} \] \[ Var(Y | \mathbf{X} = \mathbf{x}) = \sigma^2 \]

Alternatively

\[ Y = \mathbf{x}^T \mathbf{\beta} + \varepsilon \text{ where }\] \[ E(\varepsilon) = 0, Var(\varepsilon) = \sigma^2\]

Sample version: \(n\) independent observations from this model

- For \(i\)th sample point, let

- \(Y_{i}=\) response

- \(\mathbf{x}_{i}=\) \(p\)-dimensional vector of predictors

We assume that

\[ Y_{i}=\mathbf{x}_{i}^T\mathbf{\beta} + \varepsilon_{i}, \]

where \(\varepsilon_i\) are independent and

\[ E(\varepsilon_{i}) = 0, Var(\varepsilon_i) = \sigma^2 \]

In matrix notation

\[ \mathbf{Y}= \mathbf{X} \mathbf{\beta} + \mathbf{\varepsilon} \]

where \[ \mathbf{Y}=\left( \begin{array}{c} Y_{1} \\ \vdots \\ Y_{n} \end{array} \right),\, \mathbf{X=}\left( \begin{array}{c} \mathbf{x}_{1}^T \\ \vdots \\ \mathbf{x}_{n}^T \end{array} \right),\, \mathbf{\varepsilon} = \left( \begin{array}{c} \varepsilon_{1} \\ \vdots \\ \varepsilon_{n} \end{array} \right) \]

\(\mathbf{Y}\) and \(\mathbf{\varepsilon}\) are \(n\times1\)

\(\mathbf{X}\) is \(n\times p\)

Columns of \(\mathbf{X}\) are assumed to be linearly independent (\(\text{rank}(\mathbf{X}) = p\))

\(\mathbf{\beta}_{p\times 1}\) and \(\sigma^2 > 0\) are unknown parameters

Problem: How to estimate \(\mathbf{\beta}\) and \(\sigma^2\)

- Least squares approach: minimize sum of squared errors \[ \widehat{\mathbf{\beta}} = \arg\min_{\mathbf{\beta}} q(\mathbf{\beta}) \] where \[ q(\mathbf{\beta}) = \sum (Y_{i} - \mathbf{x}_{i}^T \mathbf{\beta})^{2} = (\mathbf{Y} - \mathbf{X} \mathbf{\beta})^T (\mathbf{Y} - \mathbf{X}\mathbf{\beta}) \]

Problem: How to estimate \(\mathbf{\beta}\) and \(\sigma^2\)

- Set gradient with respect to \(\mathbf{\beta}\) to \(\mathbf{0}\).

\[ \nabla q(\mathbf{\beta}) = 2 \mathbf{X}^T (\mathbf{Y-X\beta}) = 2 (\mathbf{X}^T \mathbf{Y-X}^T \mathbf{X \beta}) = \mathbf{0} \]

- This leads to Normal Equations:

\[ \mathbf{X}^T \mathbf{X \beta} = \mathbf{X}^T \mathbf{Y} \]

- Estimate of \(\mathbf{\beta}\) assuming that \(\mathbf{X}^T \mathbf{X}\) has full rank (OLS estimator):

\[ \widehat{\mathbf{\beta }} = ( \mathbf{X}^T \mathbf{X})^{-1} \mathbf{X}^T \mathbf{Y} \]

The OLS estimator in practice

fm1 <- lm(weight ~ height, data = Davis)

xyplot(weight ~ height, data = Davis, grid = TRUE, type = c("p", "r"))

The OLS estimator in practice

fm1 <- lm(repwt ~ repht, data = Davis)

xyplot(repwt ~ repht, data = Davis, grid = TRUE, type = c("p", "r"))

The OLS estimator in practice

The OLS estimator in practice

Alternative approach: maximum likelihood

Less arbitrary, but needs model assumption: Multivariate Normality

To indicate that \(\mathbf{Y}\) follows \(n\)-dimensional Multivariate Normal Distribution with mean vector \(\mu\) and covariance matrix \(\Sigma\), we write

\[ \mathbf{Y} \sim N_{n}\left(\mathbf{\mu}, \Sigma \right) \]

When \(\Sigma\) has full rank (positive definite), \(\mathbf{Y}\) has joint density function (pdf)

\[ f\left(\mathbf{y}\right) = \left( 2\pi \right) ^{-n/2}\left\vert {\Sigma }\right\vert ^{-1/2} \exp\left\lbrace -\frac{1}{2} (\mathbf{y-\mu})^T \Sigma^{-1} (\mathbf{y-\mu}) \right\rbrace \]

Note that this function has the two worst things in matrices, the determinant and the inverse of a matrix.

Alternative approach: maximum likelihood

Fortunately, the situation is simpler for the regression model \[ \mathbf{Y} \sim N_n(\mathbf{X\beta}, \sigma^2 \mathbf{I}) \] with probability density function \[ f(\mathbf{y}) = (2\pi)^{-n/2} \left( \sigma ^{2}\right)^{-n/2} \exp\left\lbrace -\frac{1}{2\sigma^2}\left\Vert \mathbf{y-X\beta }\right\Vert ^{2} \right\rbrace \]

Therefore the likelihood for this model is \[ L\left( \mathbf{\beta}, \sigma^{2} \right) = \left( 2\pi \right) ^{-n/2}\left( \sigma ^{2}\right) ^{-n/2} \exp\left\lbrace -\frac{1}{2\sigma^2}\left\Vert \mathbf{Y-X\beta }\right\Vert^{2} \right\rbrace \]

Maximizing \(L\left( \mathbf{\beta}, \sigma^{2} \right)\) w.r.t. \(\mathbf{\beta}\) is equivalent to minimizing \(\left\Vert \mathbf{Y-X\beta }\right\Vert^{2}\)

Is this a good estimator?

To answer this, we need some more tools

Mean and Covariance of a random vector \(\mathbf{Y}\) \[ \mathbf{\mu} = \left( \begin{array}{c} \mu _{1} \\ \vdots \\ \mu _{n} \end{array} \right),\, \Sigma = \left( \begin{array}{ccc} \Sigma _{11} & \cdots & \Sigma _{1n} \\ \vdots & \ddots & \vdots \\ \Sigma _{n1} & \cdots & \Sigma _{nn} \end{array} \right) \] where \[ \mu_{i}=EY_{i}, \] and \[ \Sigma_{ij}=\begin{cases} Var( Y_{i} ) & \text{for } i=j\\ Cov( Y_{i},Y_{j} ) & \text{for } i\neq j \end{cases} \]

Properties of mean and covariance

The covariance matrix is symmetric

For any \(n\times n\) matrix \(\mathbf{A}\) and \(n\times 1\) vector \(\mathbf{b}\)

\[ E\left( \mathbf{AY+b}\right) =\mathbf{A}E(\mathbf{Y}) + \mathbf{b},\text{ } \]

\[ Cov(\mathbf{AY+b}) = \mathbf{A} Cov(\mathbf{Y}) \mathbf{A}^T \]

Variance of a linear combination

\[ 0 \leq Var(\mathbf{a}^T \mathbf{Y}) = \mathbf{a}^T Cov(\mathbf{Y}) \mathbf{a} \]

which implies that the covariance matrix is non-negative definite.

Properties of the OLS estimator \(\widehat{\mathbf{\beta}}\)

Mean: \[ E\widehat{\mathbf{\beta}} = \left( \mathbf{X}^T \mathbf{X} \right)^{-1} \mathbf{X}^T E\mathbf{Y} = \left( \mathbf{X}^T \mathbf{X} \right)^{-1} \mathbf{X}^T \mathbf{X\beta} =\mathbf{\beta} \]

Covariance: \[ Cov(\widehat{\mathbf{\beta}}) = \left( \mathbf{X}^T \mathbf{X}\right) ^{-1}\mathbf{X}^T \sigma^2\mathbf{IX}\left( \mathbf{X}^T \mathbf{X}\right)^{-1}= \sigma^2\left( \mathbf{X}^T \mathbf{X}\right)^{-1}=\sigma^2 \mathbf{M} \]

Property of Multivariate Normal:

If \(\mathbf{Y} \sim N_n(\mathbf{\mu}, \Sigma)\), then \[ \mathbf{AY+b} \sim N( \mathbf{A\mu + b}, \mathbf{A} \Sigma \mathbf{A}^T) \]

Therefore \[ \widehat{\mathbf{\beta}}\sim N_{p}\left( \mathbf{\beta} ,\sigma^{2}\mathbf{M}\right) \]

Properties of the OLS estimator \(\widehat{\mathbf{\beta}}\)

- For the normal model, the OLS is the best unbiased estimator, i.e., it has smaller variance than any other unbiased estimator.

More precisely, \(\mathbf{\ell}^T \widehat{\mathbf{\beta}}\) is the best unbiased estimator of \(\mathbf{\ell}^T \mathbf{\beta}\) for any linear combination \(\mathbf{\ell}^T \mathbf{\beta}\).

- \(E(\mathbf{\ell}^T \widehat{\mathbf{\beta}}) = \mathbf{\ell}^T \mathbf{\beta}\)

- \(Var(\mathbf{\ell}^T \widehat{\mathbf{\beta}}) = \sigma^2 \mathbf{\ell}^T \left( \mathbf{X}^T \mathbf{X}\right)^{-1} \mathbf{\ell}\)

- Note that this conditional variance depends on \(\mathbf{X}\) — does distribution of \(\mathbf{X}\) matter?

- Prediction: Put \(\mathbf{\ell} = \mathbf{x}\) for some future covariates \(\mathbf{x}\)

Even without assuming normality, the OLS estimator has smaller variance than any other linear unbiased estimator.

The OLS estimator is consistent (as long as \(\mathbf{X}\) grows reasonably), i.e., \(\widehat{\mathbf{\beta}} \to \beta\) as \(n \to \infty\).

The unbiased estimator of \(\sigma^{2}\)

We typically estimate \(\sigma ^{2}\) by \[ \widehat{\sigma }^{2}=\left\Vert \mathbf{Y-X}\widehat{\beta }\right\Vert^{2}/\left( n-p\right) \] which is called the unbiased estimator of \(\sigma ^{2}\)

Distribution of \(\widehat{\sigma }^{2}\): \[ \frac{\left( n-p\right) \widehat{\sigma }^{2}}{\sigma ^{2}}\sim \chi_{n-p}^{2} \] independently of \(\widehat{\beta}\)

Properties of \(\widehat{\sigma }^{2}\)

For the normal model \(\widehat{\sigma }^{2}\) is the best unbiased estimator.

Even without normality, \(\widehat{\sigma}^{2}\) is unbiased.

\(\widehat{\sigma }^{2}\) is consistent

The maximum likelihood estimator (MLE)

To find MLE of \(\sigma^{2}\), differentiate \(\log L(\widehat{\beta}, \sigma^{2})\) with respect to \(\sigma\)

Easy to show that this gives \[ \widehat{\sigma }_{MLE}^{2} = \frac{1}{n} \left\Vert \mathbf{Y-X}\widehat{\beta }\right\Vert^{2} \]

Note that the MLE is not unbiased, but is consistent.

In general, neither the OLS estimator nor the MLE of \(\sigma^{2}\) minimize mean squared error (MSE)

Testing

We are often interested in coefficients \(\beta_{j}\)

Note that by properties given above \[ \widehat{\beta}_{j} \sim N(\beta_j, \sigma^2 M_{jj}) \]

“Standard error” of \(\widehat{\beta}_{j}\) \[ \widehat{\sigma }_{\widehat{\beta }_{j}}=\widehat{\sigma }\sqrt{M_{jj}} \]

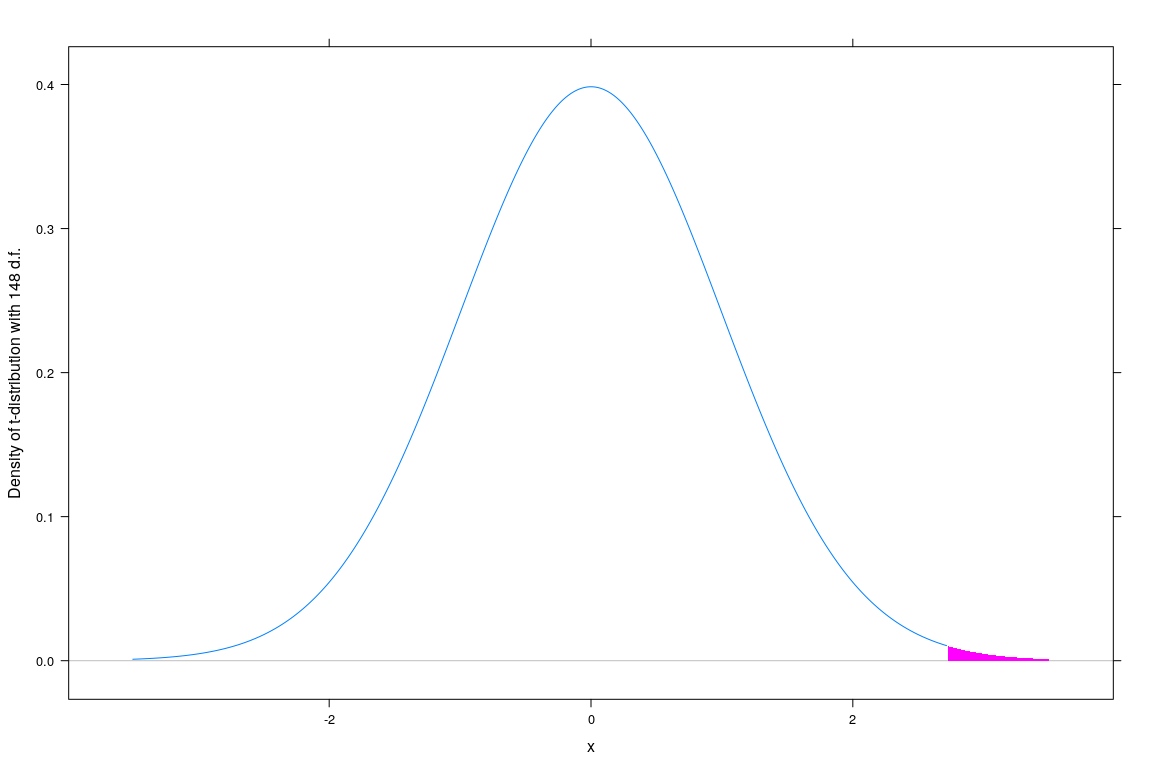

Testing: \(t\)-statistic

Testing the null hypothesis \(H_0 : \beta_{j} = c\) \[ t=\frac{\widehat{\beta}_{j} - c}{\widehat{\sigma}_{\widehat{\beta}_{j}}} \sim t_{n-p}. \]

- Can be generalized to:

- any linear combination of \(\beta_j\)

- more than one simultaneous restrictions (\(F\)-test)

\(t\)-tests in practice

Call:

lm(formula = weight ~ height, data = Davis)

Residuals:

Min 1Q Median 3Q Max

-23.696 -9.506 -2.818 6.372 127.145

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 25.26623 14.95042 1.690 0.09260

height 0.23841 0.08772 2.718 0.00715

Residual standard error: 14.86 on 198 degrees of freedom

Multiple R-squared: 0.03597, Adjusted R-squared: 0.0311

F-statistic: 7.387 on 1 and 198 DF, p-value: 0.007152\(t\)-tests - computing \(p\)-values in R

[1] 0.007150357

Testing: \(F\)-statistic

Loosely speaking,

Suppose we are interested in testing \(H_0\) vs \(H_1\), where \(H_0\) is a sub-model of \(H_1\)

\[ H_0 \subset H_1 \quad (H_m : \mathbf{Y} \sim N_n(\mathbf{X}_m \beta_m, \sigma^2 \mathbf{I}) ) \]

Let the sum of squared errors for the two models be \(S^2_0\) and \(S^2_1\)

\[ S^2_m = \left\Vert \mathbf{Y} - \mathbf{X}_m \widehat{\beta}_m \right\Vert^{2}, m = 0, 1 \]

Let the number of parameters (length of \(\beta\)) in the two models be \(p_0\) and \(p_1\)

Then the test statistic

\[ F = \frac{\frac{S_0^2 - S_1^2}{p_1-p_0}}{\frac{S_1^2}{n-p_1}} \text{ follows } F_{p_1-p_0, n-p_1} \text{ under } H_0 \]

(Cochran’s theorem, Linear Models course)

\(F\)-tests in practice

Call:

lm(formula = weight ~ height * sex, data = Davis)

Residuals:

Min 1Q Median 3Q Max

-23.091 -6.331 -0.995 6.207 41.230

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 160.49748 13.45954 11.924 < 2e-16

height -0.62679 0.08199 -7.644 9.17e-13

sexM -261.82753 32.72161 -8.002 1.05e-13

height:sexM 1.62239 0.18644 8.702 1.33e-15

Residual standard error: 10.06 on 196 degrees of freedom

Multiple R-squared: 0.5626, Adjusted R-squared: 0.556

F-statistic: 84.05 on 3 and 196 DF, p-value: < 2.2e-16\(F\)-tests in practice

Analysis of Variance Table

Model 1: weight ~ height

Model 2: weight ~ height * sex

Res.Df RSS Df Sum of Sq F Pr(>F)

1 198 43713

2 196 19831 2 23882 118.02 < 2.2e-16Measuring Goodness of Fit: Coefficient of Determination

Consider residual sum of squared errors \[ T^{2}=\sum \left( Y_{i}-\bar{Y}\right)^{2} \] and \[ S^{2}=\sum \left( Y_{i} - \mathbf{x}_i^T \widehat{\mathbf{\beta}} \right)^{2}=\left\Vert\mathbf{Y-X}\widehat{\beta }\right\Vert ^{2} \] for intercept-only model and regression model

We can think of these as measuring the “unexplained variation” in \(\mathbf{Y}\) under these two models.

- Then the coefficient of determination \(R^{2}\) is defined by \[ R^{2}=\frac{T^{2}-S^{2}}{T^{2}} = 1 - \frac{S^{2}}{T^{2}} \] Note that \[ 0\leq R^{2}\leq 1 \]

\(R^{2}\)

\(T^{2}-S^{2}\) is the amount of variation in the intercept-only model which has been explained by including the extra predictors of the regression model and

\(R^{2}\) is the proportion of the variation left in the intercept-only model which has been explained by including the additional predictors.

Link with correlation: It can be shown that for one predictor, \[ R^2 = r^2(X, Y) \]

Adjusted \(R^2\)

Note that \[ R^{2}=\frac{\frac{T^{2}}{n}-\frac{S^{2}}{n}}{\frac{T^{2}}{n}} \]

Possible alternative: substitute unbiased estimators

Adjusted \(R^{2}\): \[ R_{a}^{2}=\frac{\frac{T^{2}}{n-1}-\frac{S^{2}}{n-p}}{\frac{T^{2}}{n-1}}=1-\frac{n-1}{n-p}( 1-R^{2}) \]

Predictive \(R^2\): Leave-One-Out Cross-validation

- Disadvantage of \(R^{2}\) and adjusted \(R^{2}\)

- Evaluates fit based on same data that is used to obtain fit

- Adding more covariates will always improve \(R^2\)

- A better procedure is based on cross-validation.

Delete the \(i\)th observation and compute \(\widehat{\mathbf{\beta}}_{(-i)}\) after excluding \(i\)th observation.

Also compute the sample mean excluding the \(i\)th observation \[ \bar{Y}_{(-i)} = \frac{1}{n-1} \sum_{j\neq i} Y_{j} \]

Do this for all \(i\).

Predictive \(R^2\): Leave-One-Out Cross-validation

- Define \[ T_{p}^{2}=\sum \left( Y_{i} - \bar{Y}_{(-i)}\right)^{2} \] and \[ S_{p}^{2}=\sum \left( Y_{i}-\mathbf{x}_{i}^T \widehat{\mathbf{\beta}}_{(-i)}\right)^{2} \]

The predictive \(R^{2}\) is defined as \[ R_{p}^{2}=\frac{T_{p}^{2}-S_{p}^{2}}{T_{p}^{2}} \]

This computes the fit to the \(i\)th observation without using that observation

Better measure of goodness of model fit than \(R^{2}\) or adjusted \(R^{2}\)

Beyond linear regression (topics of this course)

Identifying violations of linear model assumptions

- Lack of fit (linearity)

- Heteroscedasticity

- Autocorrelation in errors

- Collinearity (not a violation, but still problematic)

- Discordant outliers and influential observations

- Non-normality of errors

Possible solutions

- Nonparametric regression

- More flexible “linear” regression models (e.g., splines)

- Transformations

- Modeling heteroscedasticity

- Regularization (constrain parameters)

- Variable selection

- Robust Regression

First, get familiar with R

Many other online resources available