Diagnosing Systematic Model Violations

Deepayan Sarkar

Violation of assumptions in a linear regression model

Systematic violations

- Non-normality of errors

- Nonconstant error variance

- Lack of fit (nonlinearity)

- (Autocorrelation in errors — later)

Non-normality of errors

- Why do we care? LSE is Best Linear Unbiased Estimator under assumptions of

- linearity

- constant variance

- uncorrelated errors

Even if LSE is valid, it may not be efficient, especially with heavy tailed errors (outliers)

LSE estimates conditional mean \(f(x) = E(Y | X = x)\)

Justified when distribution of \(Y | X = x\) is symmetric

May not be appropriate measure of central tendency if distribution of \(Y | X = x\) is skewed

Multimodal error distribution usually indicates presense of latent covariate

Graphical techniques

Although formal tests exist, we will focus on graphical techniques

More useful in practice because they can pinpoint nature of violation

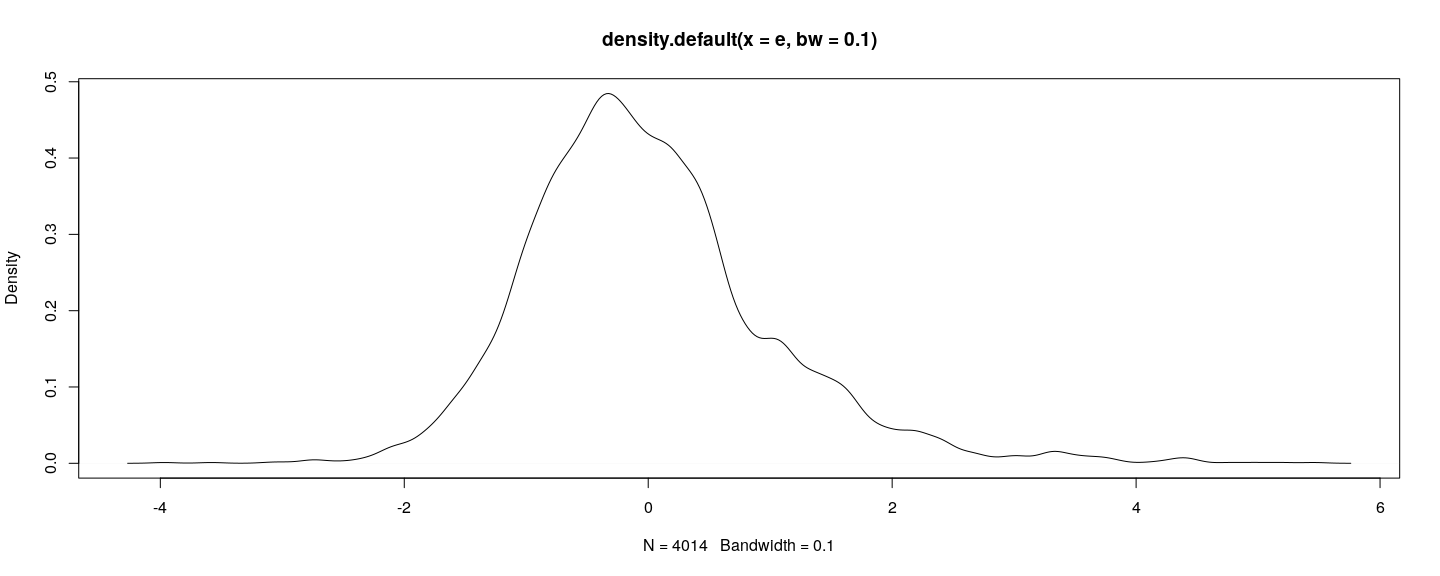

SLID <- na.omit(SLID[-5])

fm <- lm(wages ~ education + age + sex, data = SLID) # no interaction for now

e <- rstudent(fm) # should have t-distribution (not independent)

plot(density(e, bw = 0.1))

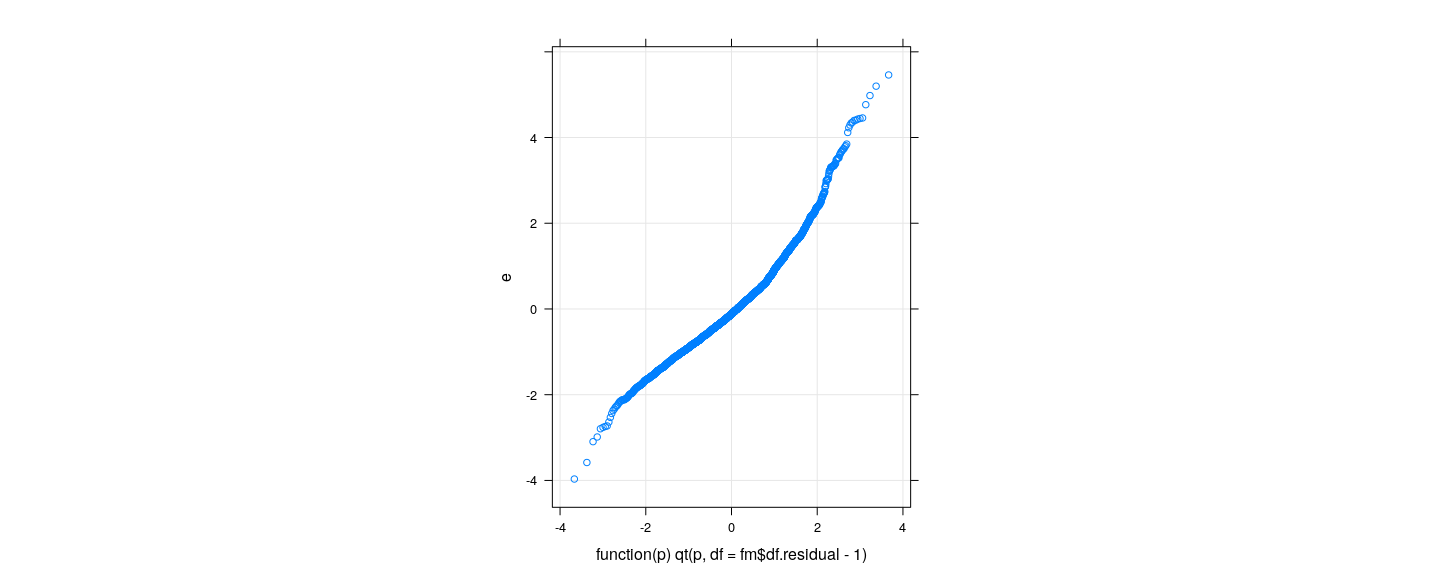

Graphical techniques

- But is there a reference to compare to?

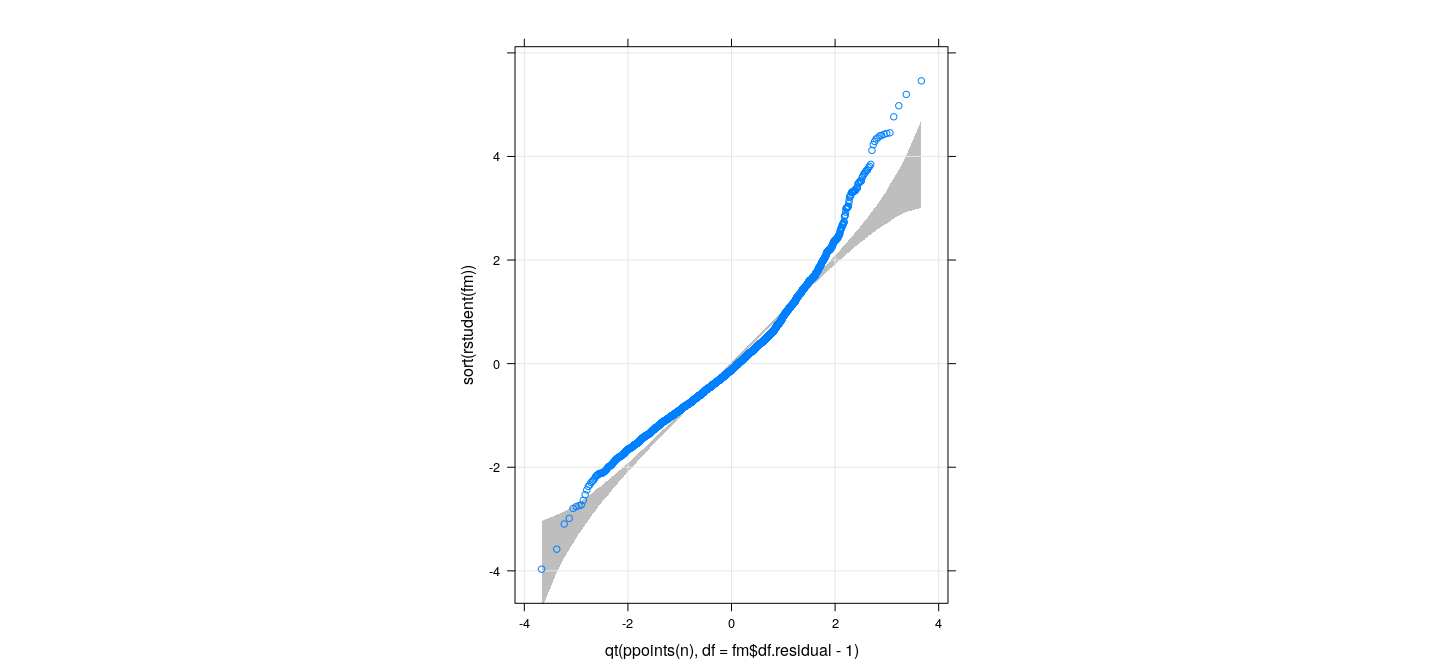

Confidence bounds for QQ-plots using Parametric Bootstrap

Dependence structure in Studentized residuals can be replicated using simulation:

- simulate \(\mathbf{y} \sim N(\mathbf{X} \hat{\beta},\hat{\sigma}^2 \mathbf{I})\)

- calculate Studentized residuals for simulated response

- provides replicates from null distribution (free of \(\beta\) and \(\sigma^2\))

Empirical (simulation) distribution of \(i\)-th order statistic gives pointwise interval

yhat <- fitted(fm)

sigma.hat <- summary(fm)$sigma

n <- length(yhat)

sime <- function()

{

SLID$ysim <- rnorm(n, mean = yhat, sd = sigma.hat)

sort(rstudent(lm(ysim ~ education + age + sex, data = SLID)))

}

esim <- replicate(5000, sime())

qsim <- apply(esim, 1, quantile, probs = c(0.005, 0.995)) # 99% pointwiseConfidence bounds for QQ-plots using Parametric Bootstrap

xyplot(sort(rstudent(fm)) ~ qt(ppoints(n), df = fm$df.residual - 1), grid = TRUE, aspect = "iso") +

layer_(panel.polygon(c(x, rev(x)), c(qsim[1,], rev(qsim[2,])), col = "grey", border = NA))

How can we address non-Normality?

Sometimes, a more general model may be appropriate (e.g., GLMs, to be studied later)

Often, transforming the response can prove useful

- E.g., variance stabilizing transformations (depending on distributions)

- \(\sqrt{y}\) for Poisson

- \(\sin^{-1} (\sqrt{y})\) for Binomial

\(\log y\) for positive-valued data (especially economic data)

Logit transform \(\log (p / (1-p))\) for proportions

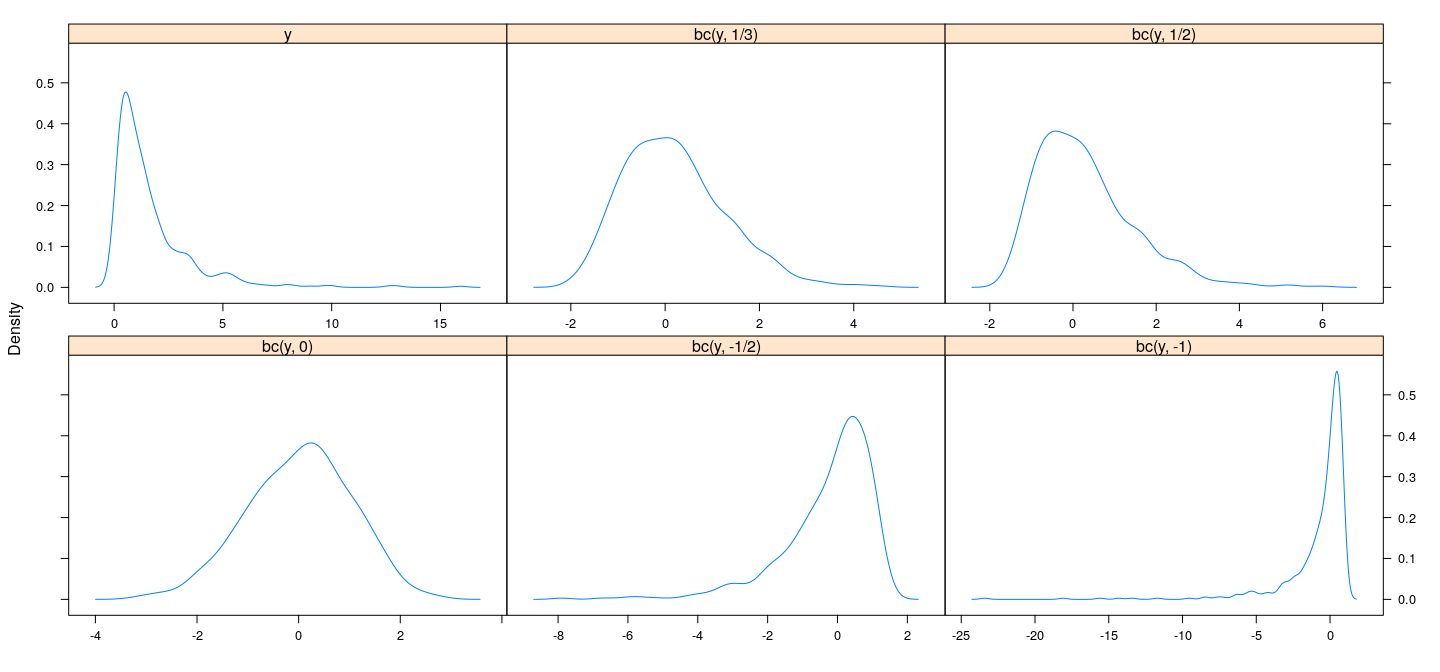

Power transformations

Generally useful family: power transformations

Box-Cox family (remains increasing for negative powers, incorporates \(\log\) as limit)

\[ g_\lambda(y) = \begin{cases} \frac{y^\lambda - 1}{\lambda} & \lambda \neq 0 \\ \log y & \lambda = 0 \end{cases} \]

Power transformations

bc <- function(x, lambda) { if (lambda == 0) log(x) else (x^lambda - 1) / lambda }

y <- rlnorm(500)

densityplot(~ y + bc(y, 1/3) + bc(y, 1/2) + bc(y, 0) + bc(y, -1/2) + bc(y, -1),

plot.points = FALSE, outer = TRUE, xlab = NULL, scales = list(x = "free"))

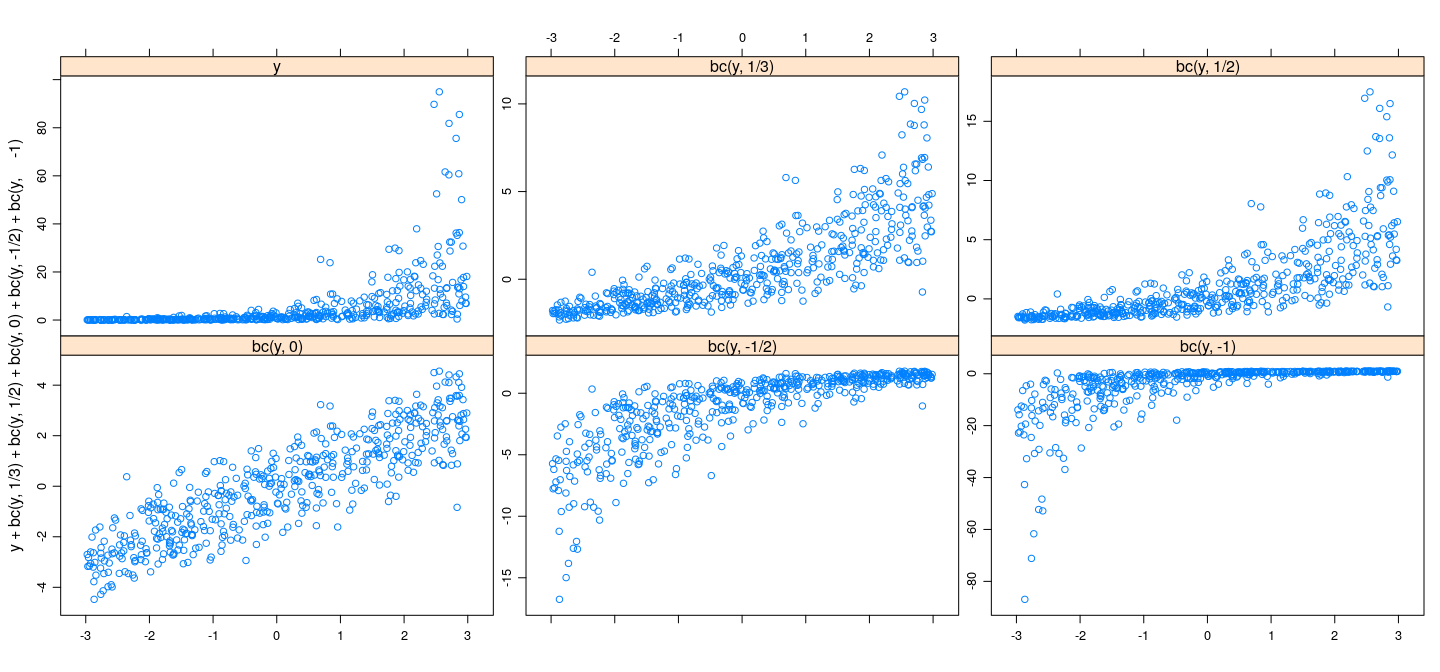

Power transformations

x <- runif(500, -3, 3)

y <- rlnorm(500, mean = x, sd = 1)

xyplot(y + bc(y, 1/3) + bc(y, 1/2) + bc(y, 0) + bc(y, -1/2) + bc(y, -1) ~ x,

plot.points = FALSE, outer = TRUE, xlab = NULL, scales = list(y = "free"))

Power transformations

Generally useful family: power transformations

Box-Cox family (remains increasing for negative powers, incorporates \(\log\) as limit)

\[ g_\lambda(y) = \begin{cases} \frac{y^\lambda - 1}{\lambda} & \lambda \neq 0 \\ \log y & \lambda = 0 \end{cases} \]

\(\lambda\) can be “estimated” using a formal approach (will discuss later)

More common to guess based on context

In this case, error distribution is right-skewed, so could try \(\log\), square root, cube root, etc.

- Important to note that (non-linear) transformations affect many aspects together:

- Distribution of errors

- Linearity

- Nonconstant error variance

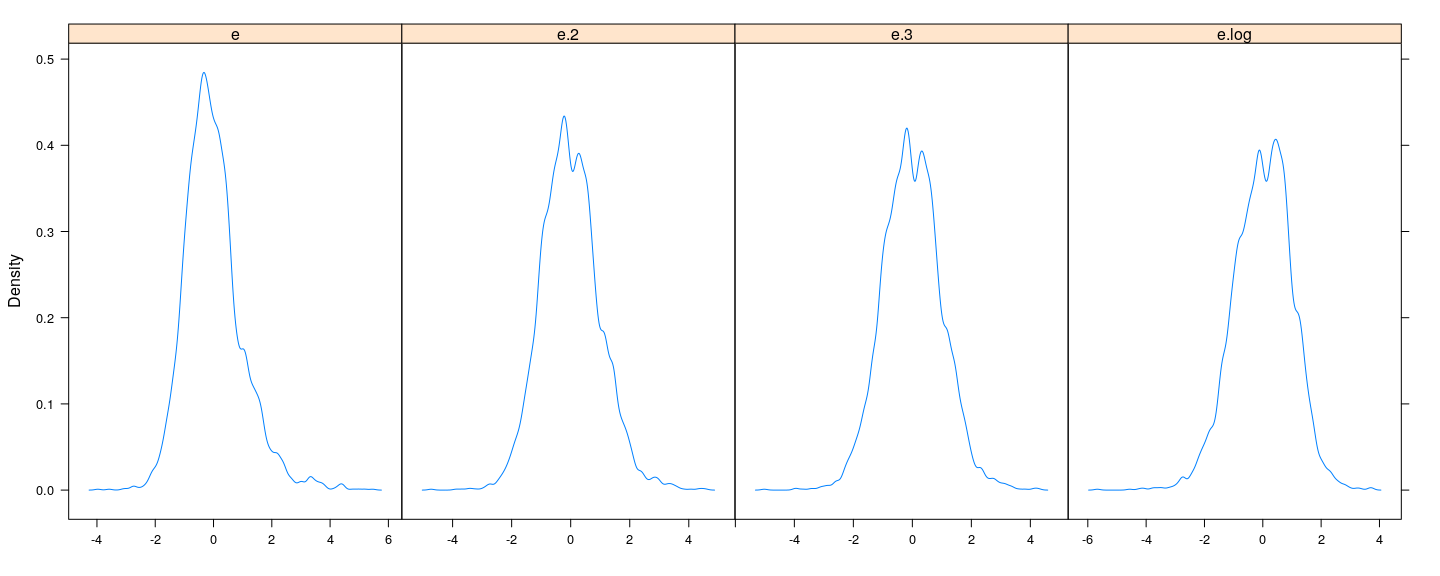

Modeling transformed data

e.2 <- rstudent(fm.2 <- lm(bc(wages, 1/2) ~ education + age + sex, data = SLID))

e.3 <- rstudent(fm.3 <- lm(bc(wages, 1/3) ~ education + age + sex, data = SLID))

e.log <- rstudent(fm.log <- lm(log(wages) ~ education + age + sex, data = SLID))

densityplot(~ e + e.2 + e.3 + e.log, bw = 0.1, plot.points = FALSE, outer = TRUE,

xlab = NULL, scales = list(x = "free"))

Modeling transformed data

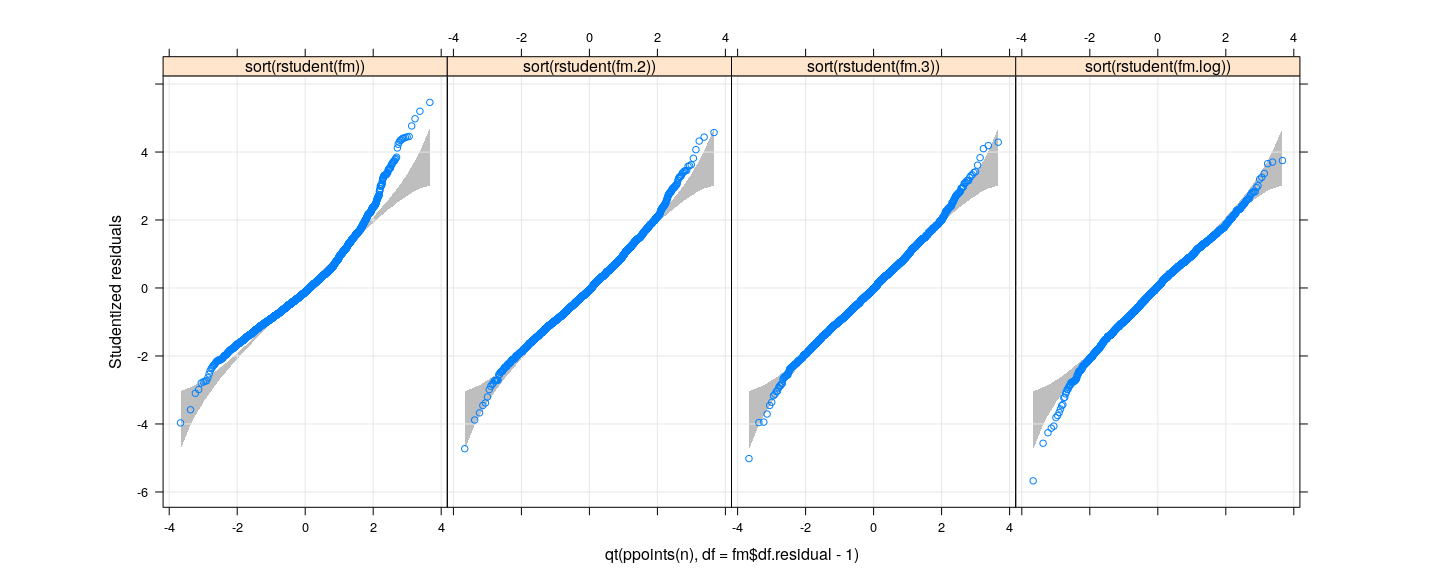

xyplot(sort(rstudent(fm)) + sort(rstudent(fm.2)) + sort(rstudent(fm.3)) +

sort(rstudent(fm.log)) ~ qt(ppoints(n), df = fm$df.residual - 1),

outer = TRUE, grid = TRUE, aspect = "iso", ylab = "Studentized residuals") +

layer_(panel.polygon(c(x, rev(x)), c(qsim[1,], rev(qsim[2,])), col = "grey", border = NA))

The same confidence bounds work for all cases! (exercise)

Formal tests: Kolmogorov-Smirnoff

One-sample Kolmogorov-Smirnov test

data: e

D = 0.063411, p-value = 1.91e-14

alternative hypothesis: two-sided

One-sample Kolmogorov-Smirnov test

data: e.log

D = 0.025792, p-value = 0.009588

alternative hypothesis: two-sided

One-sample Kolmogorov-Smirnov test

data: e.3

D = 0.015434, p-value = 0.2946

alternative hypothesis: two-sidedFormal tests: Shapiro-Wilk test

Shapiro-Wilk normality test

data: e

W = 0.95974, p-value < 2.2e-16

Shapiro-Wilk normality test

data: e.log

W = 0.99431, p-value = 1.844e-11

Shapiro-Wilk normality test

data: e.3

W = 0.99662, p-value = 7.311e-08More details: Kolmogorov-Smirnoff test

Null hypothesis: \(X_1, \dotsc, X_n \sim \text{ i.i.d. } F_0\) (where \(F_0\) is a completely specified absolutely continuous CDF)

Empirical CDF

\[\hat{F}_n(x) = \frac{1}{n} \sum_i \mathbf{1} \{ X_i \leq x \}\]

- Test statistic:

\[T(X_1, \dotsc, X_n) = \sup_{x \in \mathbb{R}} \lvert \hat{F}_n(x) - F_0(x) \rvert\]

- Note that

- null distribution of \(T\) does not depend on \(F_0\) (use \(U_i = F_0(X_i) \sim \text{ i.i.d. } U(0, 1)\) instead)

- Intuitively, large value of \(T\) indicates departure from null, so reject when \(T\) is large

- \(p\)-value can be approximated using simulation

- Can also be estimated conservatively using the DKW inequality

More details: Shapiro-Wilk test

Null hypothesis: \(X_1, \dotsc, X_n \sim \text{ i.i.d. } N(\mu, \sigma^2)\) for some \(\mu, \sigma^2\)

Test statistic

\[W = \frac{ (\sum_i a_i X_{(i)})^2 }{\sum_i (X_i - \bar{X})^2}\]

- where

\[\mathbf{a} = \frac{\mathbf{m}^T \mathbf{V}}{\sqrt{\mathbf{m}^T \mathbf{V}^{-1} \mathbf{V}^{-1} \mathbf{m}} }\]

with \(\mathbf{m}\) and \(\mathbf{V}\) the mean vector and variance-covariance matrix of \((Z_{(1)}, \dotsc, Z_{(n)})^T\), where \(Z_1, \dotsc, Z_n \sim \text{ i.i.d. } N(0, 1)\)

The motivation (and implementation) for this test is slightly complicated, but the basic idea is that \(\sum_i a_i X_{(i)}\) estimates the slope of the Normal Q-Q plot (which is an estimate of \(\sigma\)). See Shapiro and Wilk, 1965 for details.

Summary

log, square root, cube root all reasonable (graphically)

Formal tests are sometimes too sensitive (especially for large data)

Formal tests useful, but should not be taken too seriously

Nonconstant error variance

No obvious way to detect unless there is a systematic pattern

Typical patterns:

\(V(Y | X = x)\) depends on \(E(Y | X = x)\)

\(V(Y | X = x)\) depends on \(x\)

Graphical methods: plot residuals against fitted values / covariates

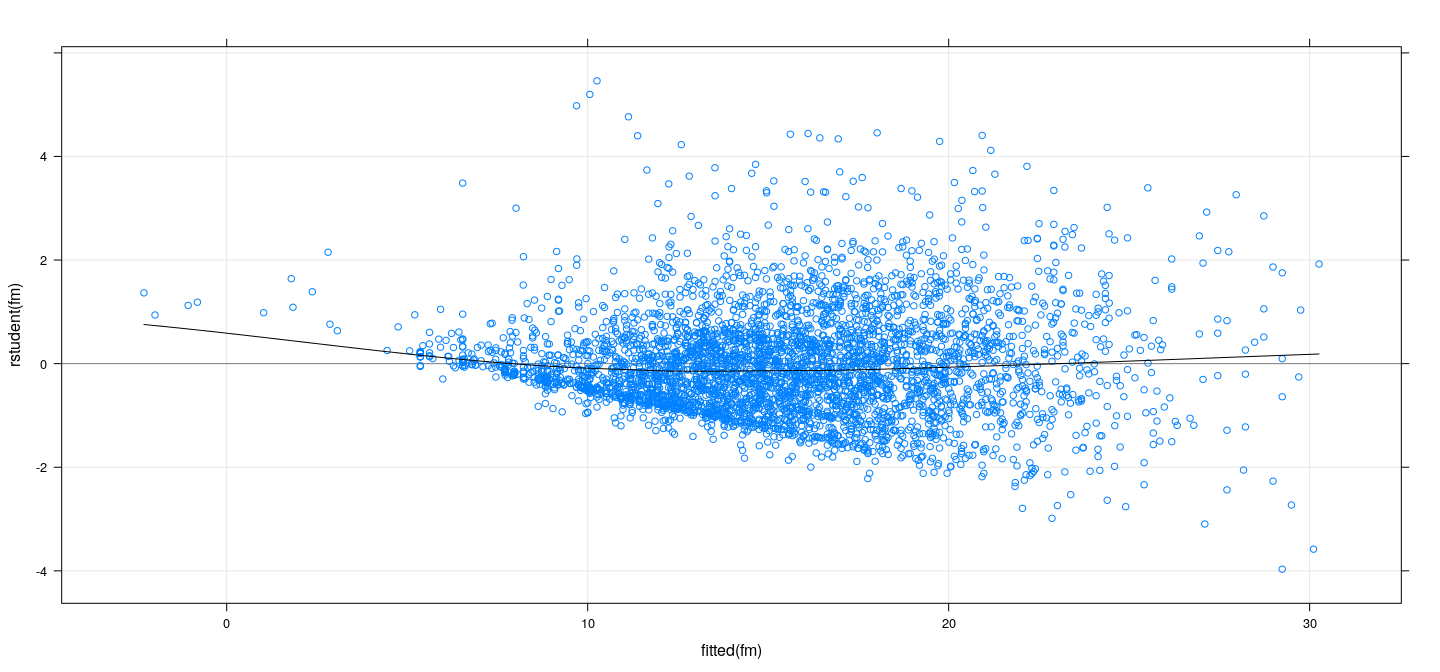

Plotting Residuals vs fitted values

Residuals (\(\mathbf{y} - \hat{\mathbf{y}}\)) are uncorrelated with fitted values (\(\hat{\mathbf{y}}\)) (but not with \(\mathbf{y}\))

Residuals have unequal variances, so preferable to plot Studentized residuals

If true error variances depend on \(E(Y | X = x)\), we expect to see the same dependence in plot

More useful to plot absolute Studentized residuals (\(\lvert t_i \rvert\)) along with a non-parametric smoother

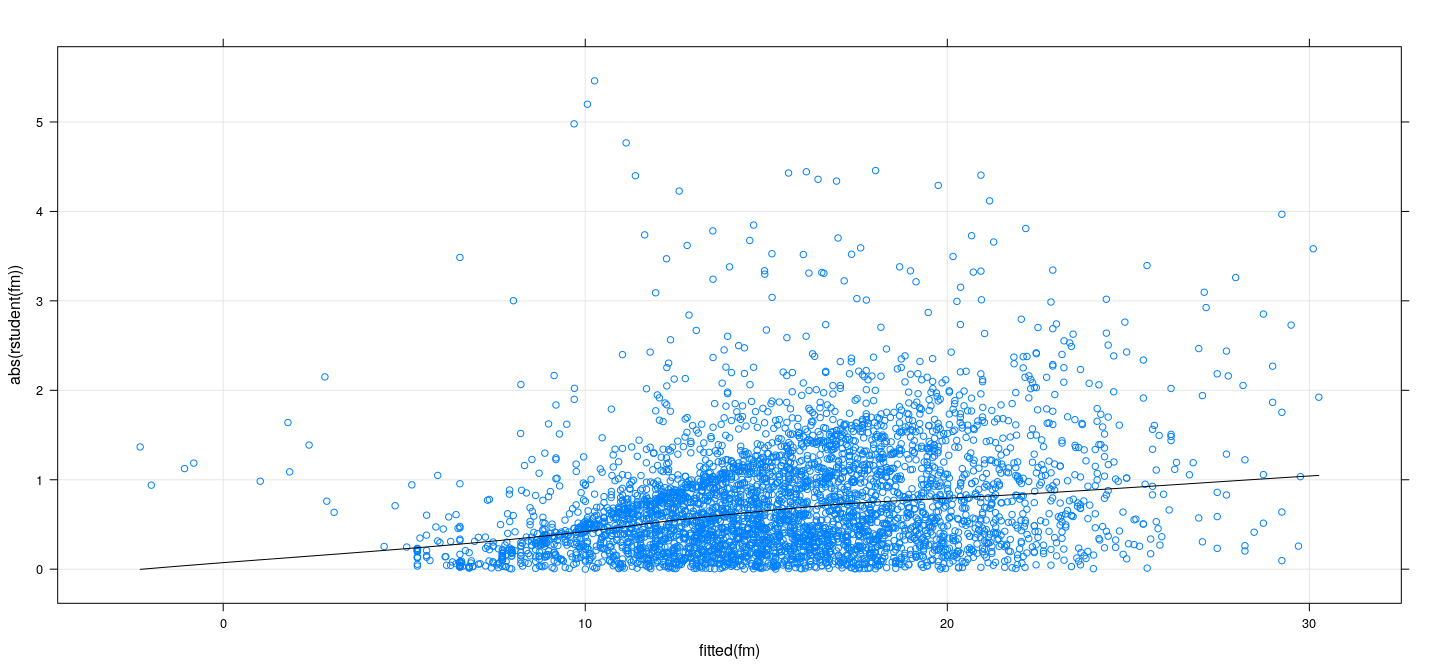

Studentized residuals vs fitted values

fm <- lm(wages ~ education + age + sex, data = SLID)

xyplot(rstudent(fm) ~ fitted(fm), type = c("p", "smooth"), grid = TRUE,

col.line = "black", abline = list(h = 0, col = "grey50"))

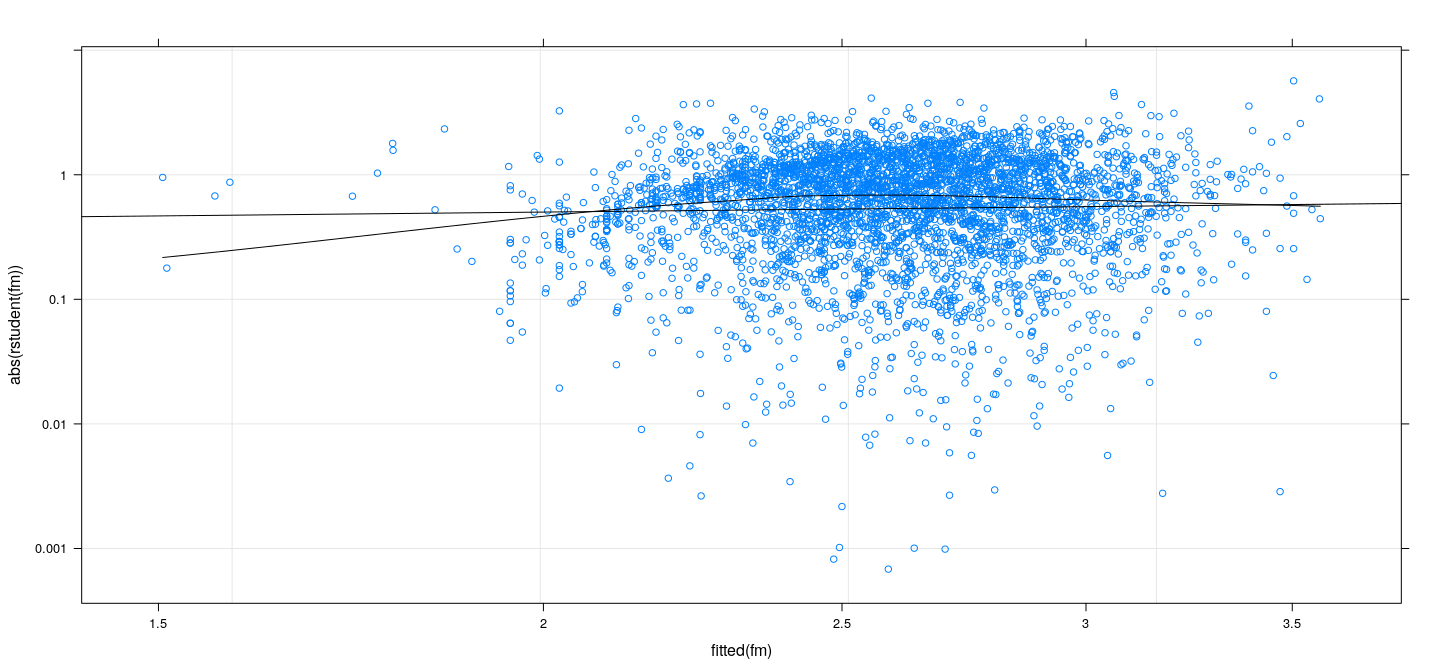

Absolute Studentized residuals vs fitted values

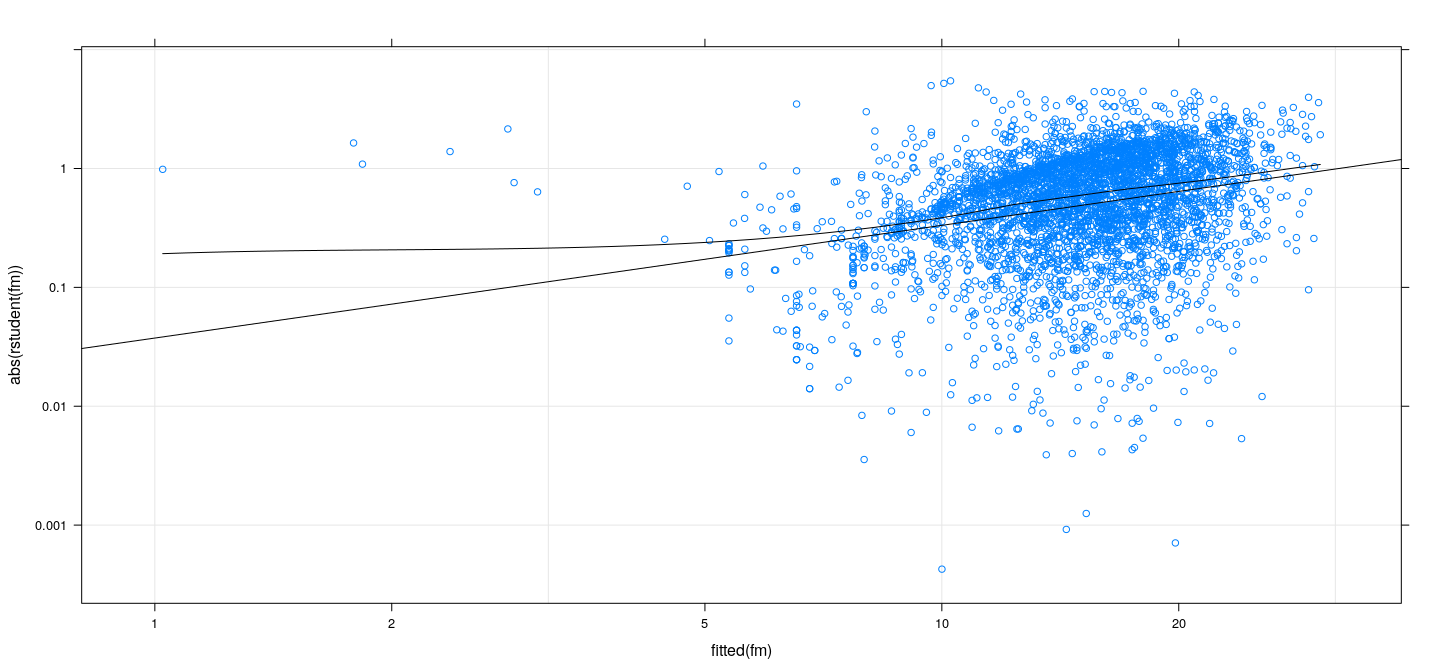

Spread-level plots

Suppose (most) fitted values are positive

We can plot both absolute residuals and fitted values in log scales

A linear relationship in this plot suggests a power transformation

Spread-level plots

xyplot(abs(rstudent(fm)) ~ fitted(fm), type = c("p", "r", "smooth"), grid = TRUE,

col.line = "black", scales = list(log = TRUE, equispaced.log = FALSE))

Spread-level plots and power transformations

Let \(\mu = E(Y)\) and suppose \(V(Y) = h(\mu) = (a \mu^b)^2\)

What is the variance stabilizing transformation?

Empirical rule: \(g(Y)\) has approximately constant variance where

\[ g(y) = \int \frac{C}{\sqrt{h(y)}} dy = C \int y^{-b} dy = C y^{1-b} \]

Spread-level plots and power transformations

On the other hand, errors \(\varepsilon = Y - \mu\) satisfy

- \(E\lvert \varepsilon \rvert \propto a \mu^b\)

- \(\log E\lvert \varepsilon \rvert \approx \log c + b \log \mu\)

Thus \(b\) can be estimated from spread-level plot

Call:

lm(formula = log(abs(rstudent(fm))) ~ log(fitted(fm)))

Coefficients:

(Intercept) log(fitted(fm))

-3.284 0.948

- Suggested power transform \(Y^{(1-b)} \approx Y^{0.05} \approx \log Y\)

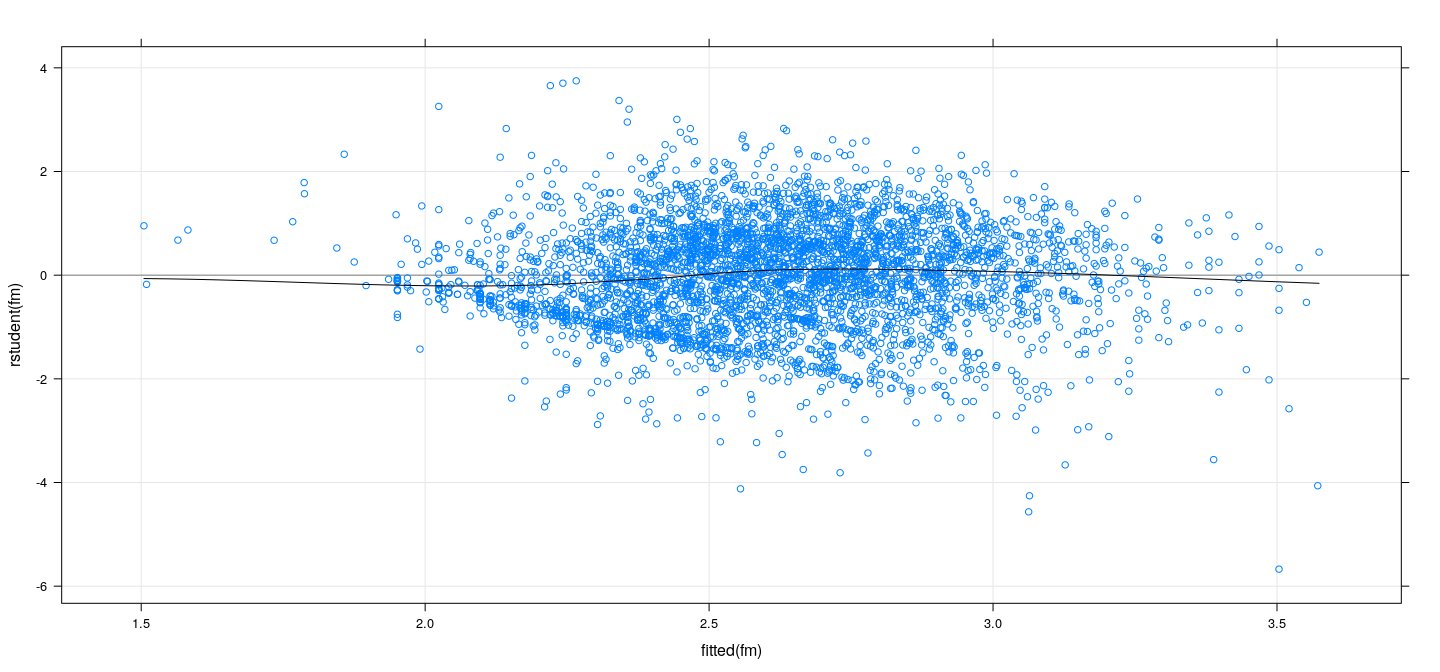

Residuals vs fitted values (after transforming)

fm <- lm(log(wages) ~ education + age + sex, data = SLID)

xyplot(rstudent(fm) ~ fitted(fm), type = c("p", "smooth"), grid = TRUE,

col.line = "black", abline = list(h = 0, col = "grey50"))

Residuals vs fitted values (after transforming)

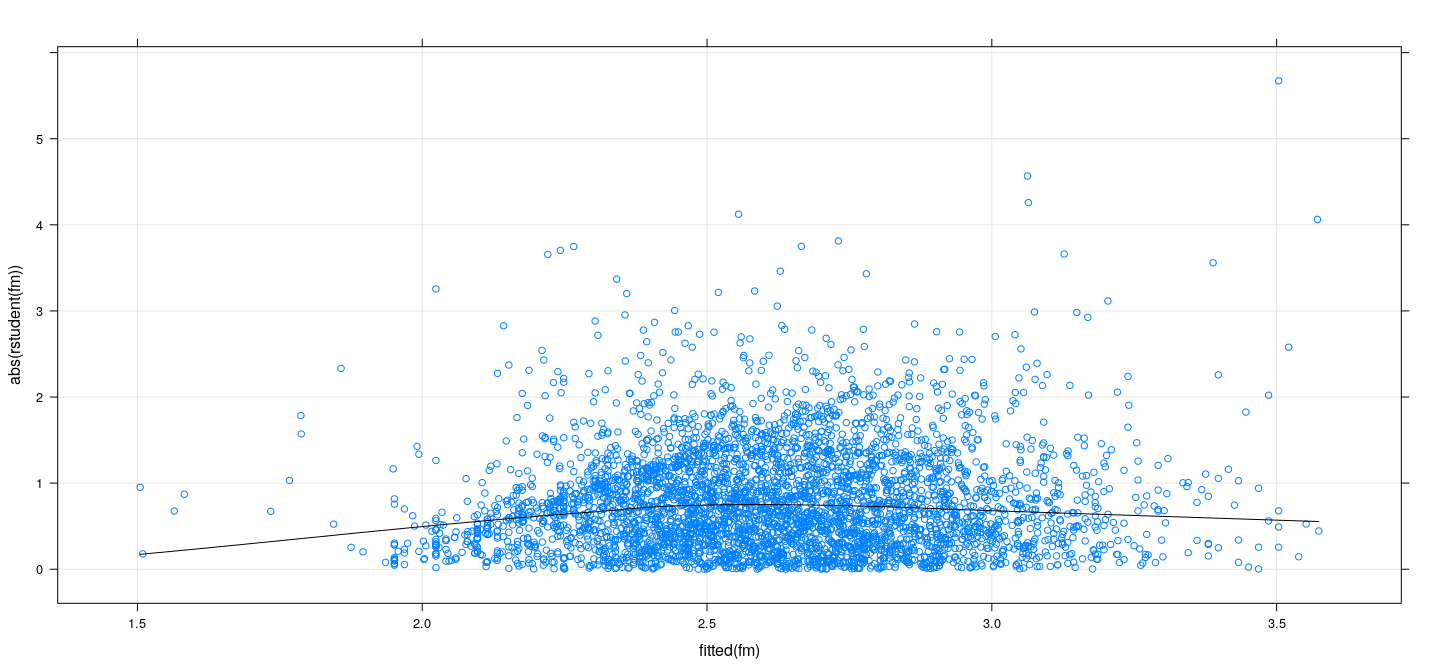

Spread-level plot (after transforming)

xyplot(abs(rstudent(fm)) ~ fitted(fm), type = c("p", "r", "smooth"), grid = TRUE,

col.line = "black", scales = list(log = TRUE, equispaced.log = FALSE))

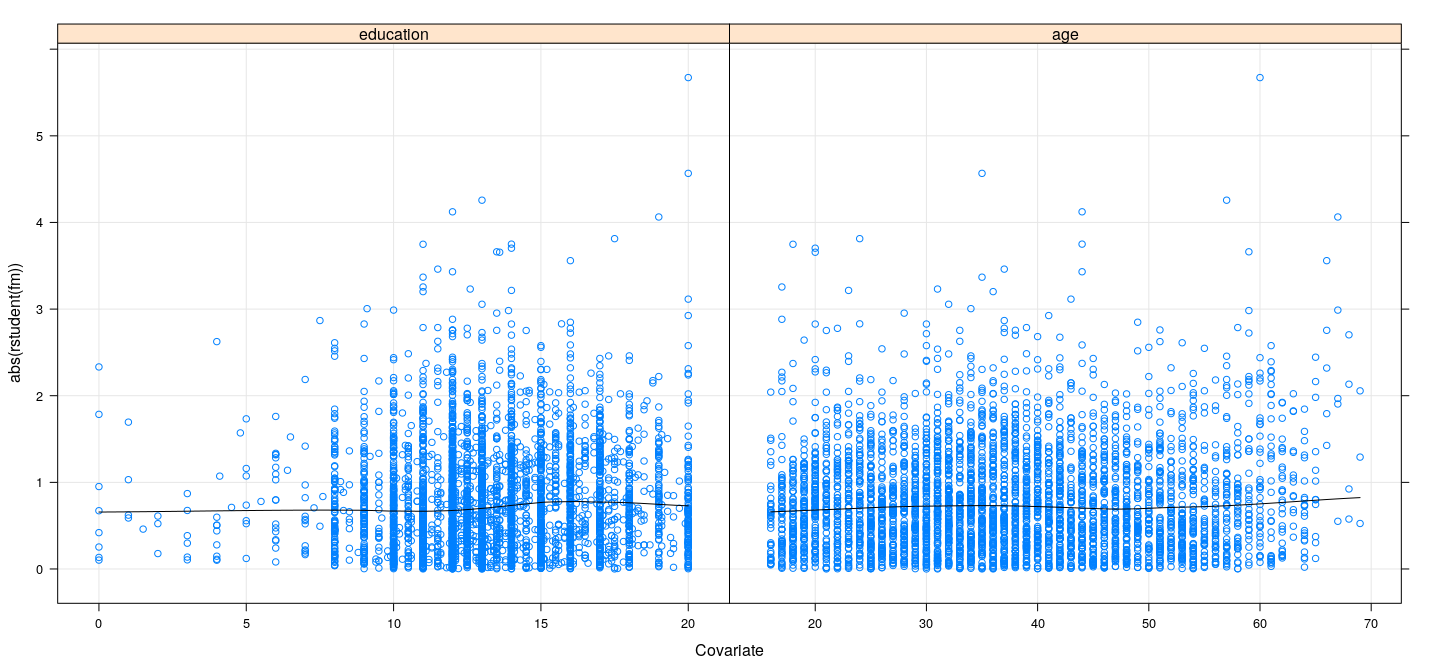

Residuals vs covariates

fm <- lm(log(wages) ~ education + age + sex, data = SLID)

xyplot(abs(rstudent(fm)) ~ education + age, data = SLID, type = c("p", "smooth"),

grid = TRUE, col.line = "black", outer = TRUE, xlab = "Covariate",

scales = list(x = "free"))

Weighted least-squares estimation

Suppose we can find known weights \(w_i\) such that \(E(y_i | \mathbf{x}_i) = \mathbf{x}_i^T \mathbf{\beta}\) and \(V(y_i | \mathbf{x}_i) = \sigma^2 / w_i^2\)

Let \(\mathbf{W}\) be a diagonal matrix with entries \(w_i^2\) and \(\mathbf{\Sigma} = \sigma^2 \mathbf{W}^{-1}\). Then

\[ \mathbf{y} \sim N( \mathbf{X} \mathbf{\beta}, \mathbf{\Sigma} ) \]

- The likelihood function is given by

Weighted least-squares estimation

- Maximum likelihood estimators are easily seen (exercise) to be given by

\[ \hat{\mathbf{\beta}} = (\mathbf{X}^T \mathbf{W} \mathbf{X})^{-1} \mathbf{X}^T \mathbf{W} \mathbf{y}\,,\quad \hat{\sigma}^2 = \frac1{n} \sum w_i^2 (y_i - \mathbf{x}_i^T \hat{\mathbf{\beta}})^2 \]

- In R,

lm()supports weighted least squares through theweightsargument

Effect of non-constant variance on OLS estimates

Let \(E(\mathbf{y}) = \mathbf{X} \beta\) and \(V(\mathbf{y}) = \mathbf{\Sigma} = diag\{ \sigma_1^2, \dotsc, \sigma_n^2 \}\)

Suppose we ignore non-constant variance and estimate \(\beta\) using OLS.

\(\hat\beta\) is still unbiased:

\[E(\hat\beta) = (\mathbf{X}^T\mathbf{X})^{-1} \mathbf{X}^T E(\mathbf{y}) = (\mathbf{X}^T\mathbf{X})^{-1} \mathbf{X}^T \mathbf{X} \beta = \beta\]

- Variance is given by

\[V(\hat\beta) = (\mathbf{X}^T\mathbf{X})^{-1} \mathbf{X}^T \mathbf{\Sigma} \mathbf{X} (\mathbf{X}^T\mathbf{X})^{-1}\]

- For a linear function

\[V(\ell^T \hat\beta) = \ell^T (\mathbf{X}^T\mathbf{X})^{-1} \mathbf{X}^T \mathbf{\Sigma} \mathbf{X} (\mathbf{X}^T\mathbf{X})^{-1} \ell\]

- WLS may not be worth the effort if more or less same as OLS standard error

Detecting need for addressing non-constant variance

How can we quickly assess need for WLS?

Suppose we don’t know structural form of \(\mathbf{\Sigma}\) (e.g., which covariates affect variance)

We still know that \(E(\varepsilon_i^2) = \sigma_i^2\)

Natural estimate of \(\sigma_i^2\) after fitting OLS model: \(e_i^2\) or \(e_{i(-i)}^2\), giving \(\hat{\mathbf{\Sigma}}\)

This gives White’s “sandwich estimator”

\[\hat{V}(\hat\beta) = (\mathbf{X}^T\mathbf{X})^{-1} \mathbf{X}^T \hat{\mathbf{\Sigma}} \mathbf{X} (\mathbf{X}^T\mathbf{X})^{-1}\]

White (1980) shows that this is consistent with \(\hat{\sigma}_i^2 = e_i^2\)

Long and Erwin (2000) show that \(\hat{\sigma}_i^2 = e_{i(-i)}^2\) performs better in small samples

How does this help?

We have two alternative estimates of \(V(\hat\beta)\): the OLS and the sandwich estimator

Can obtain corresponding standard errors for \(\ell^T \hat{\beta}\) (in particular for \(t\)-tests for \(\beta_j\)-s)

General strategy:

- If the standard errors using the two methods are substantially similar, OLS is sufficient

- Otherwise, need to address non-constant variance

- This does not suggest any particular remedy: usual approach is to try transformations

How does this help?

- Example:

SLIDdata

library(car) # for hccm

fm <- lm(log(wages) ~ education + age + sex, data = SLID)

summary(fm) # Q: does the standard errors of estimated coefficients change?

Call:

lm(formula = log(wages) ~ education + age + sex, data = SLID)

Residuals:

Min 1Q Median 3Q Max

-2.36252 -0.27716 0.01428 0.28625 1.56588

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.1168632 0.0385480 28.97 <2e-16 ***

education 0.0552139 0.0021891 25.22 <2e-16 ***

age 0.0176334 0.0005476 32.20 <2e-16 ***

sexMale 0.2244032 0.0132238 16.97 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.4187 on 4010 degrees of freedom

Multiple R-squared: 0.3094, Adjusted R-squared: 0.3089

F-statistic: 598.9 on 3 and 4010 DF, p-value: < 2.2e-16How does this help?

- Example:

SLIDdata

(Intercept) education age sexMale

(Intercept) 1.485945e-03 -6.903578e-05 -1.278690e-05 -9.428603e-05

education -6.903578e-05 4.792018e-06 1.275037e-07 7.454834e-07

age -1.278690e-05 1.275037e-07 2.999080e-07 -7.403851e-08

sexMale -9.428603e-05 7.454834e-07 -7.403851e-08 1.748681e-04 (Intercept) education age sexMale

0.0385479539 0.0021890678 0.0005476385 0.0132237691 How does this help?

- Example:

SLIDdata

(Intercept) education age sexMale

(Intercept) 1.493908e-03 -7.018477e-05 -1.374008e-05 -7.108659e-05

education -7.018477e-05 4.946819e-06 1.370821e-07 6.523566e-07

age -1.374008e-05 1.370821e-07 3.420460e-07 -7.115594e-07

sexMale -7.108659e-05 6.523566e-07 -7.115594e-07 1.750330e-04(Intercept) education age sexMale

0.038651104 0.002224144 0.000584847 0.013230005 How does this help?

- Example:

SLIDdata

(Intercept) education age sexMale

(Intercept) 1.499263e-03 -7.045519e-05 -1.378453e-05 -7.136218e-05

education -7.045519e-05 4.964996e-06 1.377771e-07 6.614334e-07

age -1.378453e-05 1.377771e-07 3.430706e-07 -7.121512e-07

sexMale -7.136218e-05 6.614334e-07 -7.121512e-07 1.753998e-04 (Intercept) education age sexMale

0.0387203216 0.0022282270 0.0005857223 0.0132438591 Formal tests for nonconstant variance

- Model \(\sigma_i\)-s are not constant, but have the form

\[ \sigma_i^2 = V(\varepsilon_i) = g(\gamma_0 + \gamma_1 Z_{i1} + \cdots + \gamma_p Z_{ip}) \]

Here \(Z_{ij}\)-s are known (possibly same as \(X_{ij}\)-s)

In other words, variance is a function of a linear combination of known covariates

Null hypothesis: \(\gamma_1 = \cdots = \gamma_p = 0\)

Can be “tested” using an auxiliary regression with “response”

\[ u_i = \frac{e_i^2}{\frac{1}{n}\sum_k e_k^2} = \frac{e_i^2}{\hat{\sigma}^2_{MLE}} \]

Formal tests for nonconstant variance

- Breusch-Pagan test: Regress \(u_i\)-s on \(Z_{ij}\)-s:

\[ u_i = \eta_0 + \eta_1 Z_{i1} + \cdots + \eta_p Z_{ip} + \omega_i \]

- Test statistic (with \(\hat{u}_i\) fitted values from the regression):

\[ S_0^2 = \frac{1}{2} \sum_i (\hat{u}_i - \bar{u})^2 \]

Under \(H_0\), \(S_0^2\) has an asymptotic \(\chi^2\) distribution with \(p\) degrees of freedom (Breusch and Pagan, 1979)

Choice of \(Z_{ij}\)-s depends on suspected pattern of heteroscedasticity; could be all covariates

Formal tests for nonconstant variance

- Special case (Cook and Weisberg, 1983): more specific form of \(\sigma_i^2\)

\[ \sigma_i^2 = \eta_0 + \eta_1 (\mathbf{x}_i^T \beta) + \omega_i \]

- Test by fitting the model

\[ u_i = \eta_0 + \eta_1 \hat{y}_i + \omega_i \]

Test for \(H_0: \eta_1 = 0\) (one degree of freedom)

More powerful test when heteroscedasticity follows this pattern

Formal tests for nonconstant variance: example

SLIDdata,wagesas response

Non-constant Variance Score Test

Variance formula: ~ fitted.values

Chisquare = 310.6546 Df = 1 p = 1.572642e-69 Non-constant Variance Score Test

Variance formula: ~ education + age

Chisquare = 297.4689 Df = 2 p = 2.54358e-65 Formal tests for nonconstant variance: example

SLIDdata,log(wages)as response

Non-constant Variance Score Test

Variance formula: ~ fitted.values

Chisquare = 28.09925 Df = 1 p = 1.152505e-07 Non-constant Variance Score Test

Variance formula: ~ education + age + sex

Chisquare = 38.44827 Df = 3 p = 2.271575e-08 Nonlinearity

Non-linearity means the modeled expectation \(E(\mathbf{y}) = \mathbf{X} \beta\) is not adequate

In multiple regression, with many predictors, this may be difficult to detect

Usual strategy: look for indicative patterns in residuals for one predictor at a time

Simplest option is to plot residuals against predictor

But this may not be able to distinguish between monotone and non-monotone relationships

Important to do so because monotone nonlinearity can often be corrected using transformation

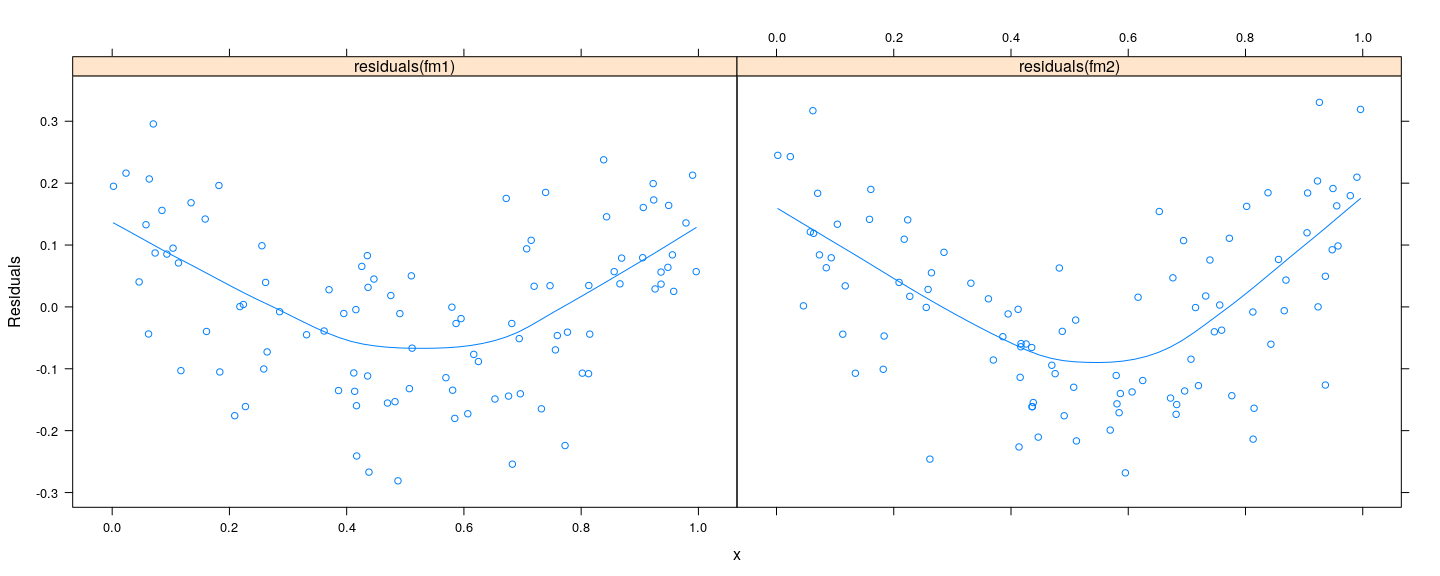

Residual vs covariate: example

n <- 100; x <- runif(n)

y1 <- x^2 + rnorm(n, sd = 0.1)

y2 <- 1 - x + x^2 + rnorm(n, sd = 0.1)

fm1 <- lm(y1 ~ x)

fm2 <- lm(y2 ~ x)

xyplot(residuals(fm1) + residuals(fm2) ~ x, type = c("p", "smooth"), outer = TRUE, ylab = "Residuals")

Residual vs covariate: example

- Similar residual plots, but nature of models are different

- First model can be made linear by transformation (true model: \(y = \alpha + \beta x^2 + \varepsilon\))

- Second model is truly quadratic ((true model: \(y = \alpha + \beta x + \gamma x^2 + \varepsilon\))

Component plus residual plots

X-axis: \(j\)-th covariate (more accurately, \(j\)-th column of \(\mathbf{X}\))

Y-axis: partial residuals of \(\mathbf{y}\) on \(\mathbf{X}\) excluding \(j\)-th column:

\[e_i^{(-j)} = e_i + \hat{\beta}_j X_{ij}\]

In other words, add back the contribution of the \(j\)-th covariate

Similar to added-variable plots, but covariate is not adjusted

Add non-parametric smoother to detect non-linearity

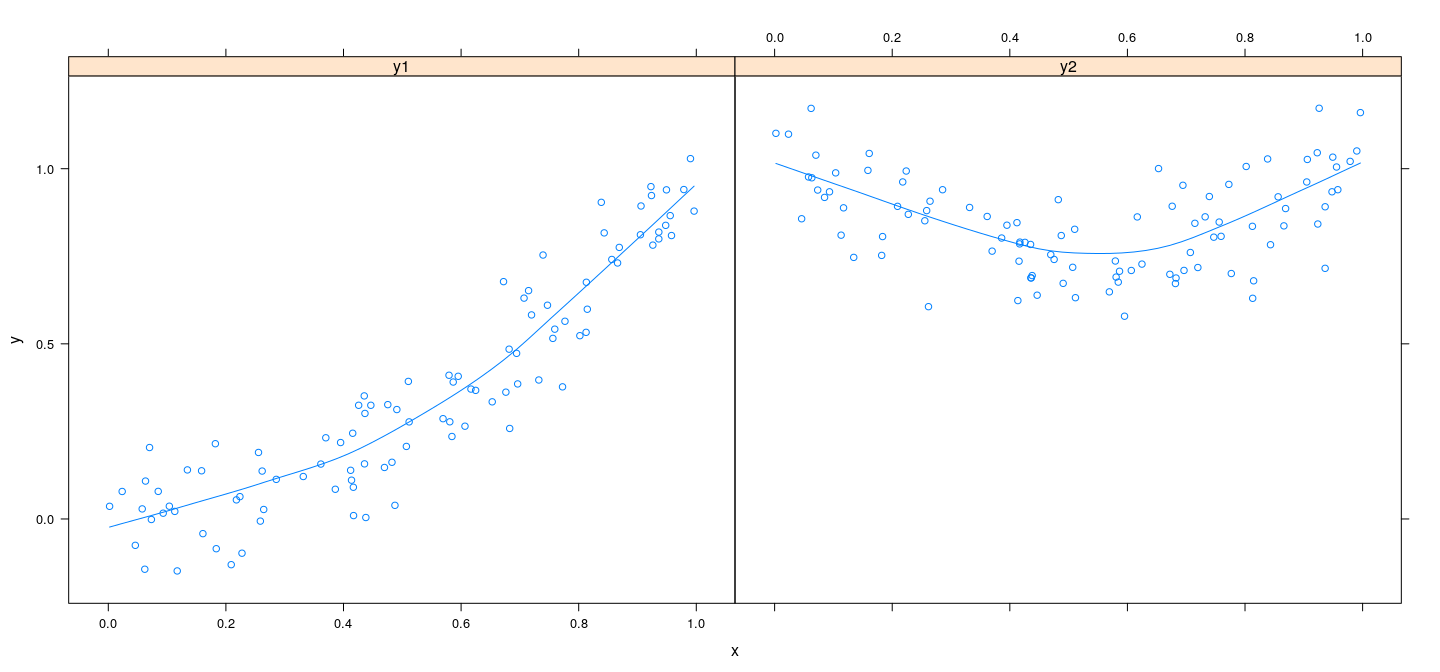

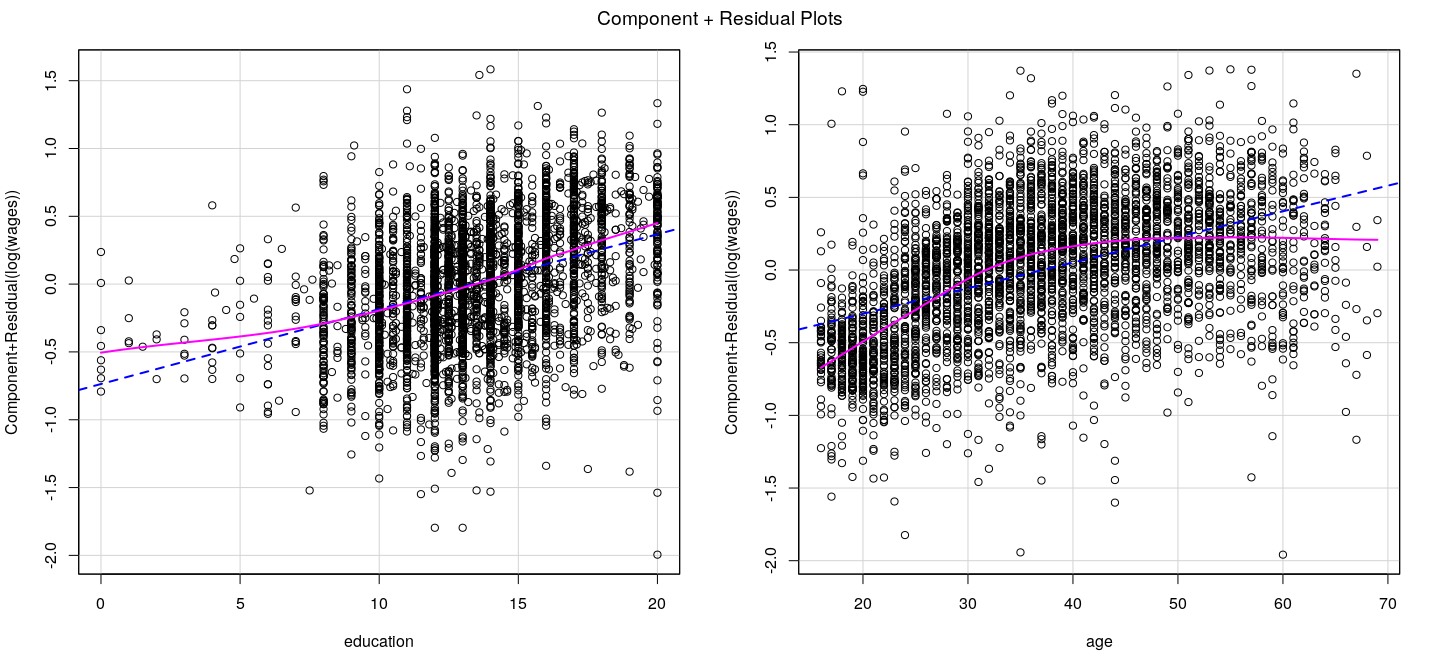

Component plus residual plots: example

fm <- lm(log(wages) ~ education + age + sex, data = SLID)

crPlots(fm, ~ education + age, layout = c(1, 2))

Component plus residual plots: example

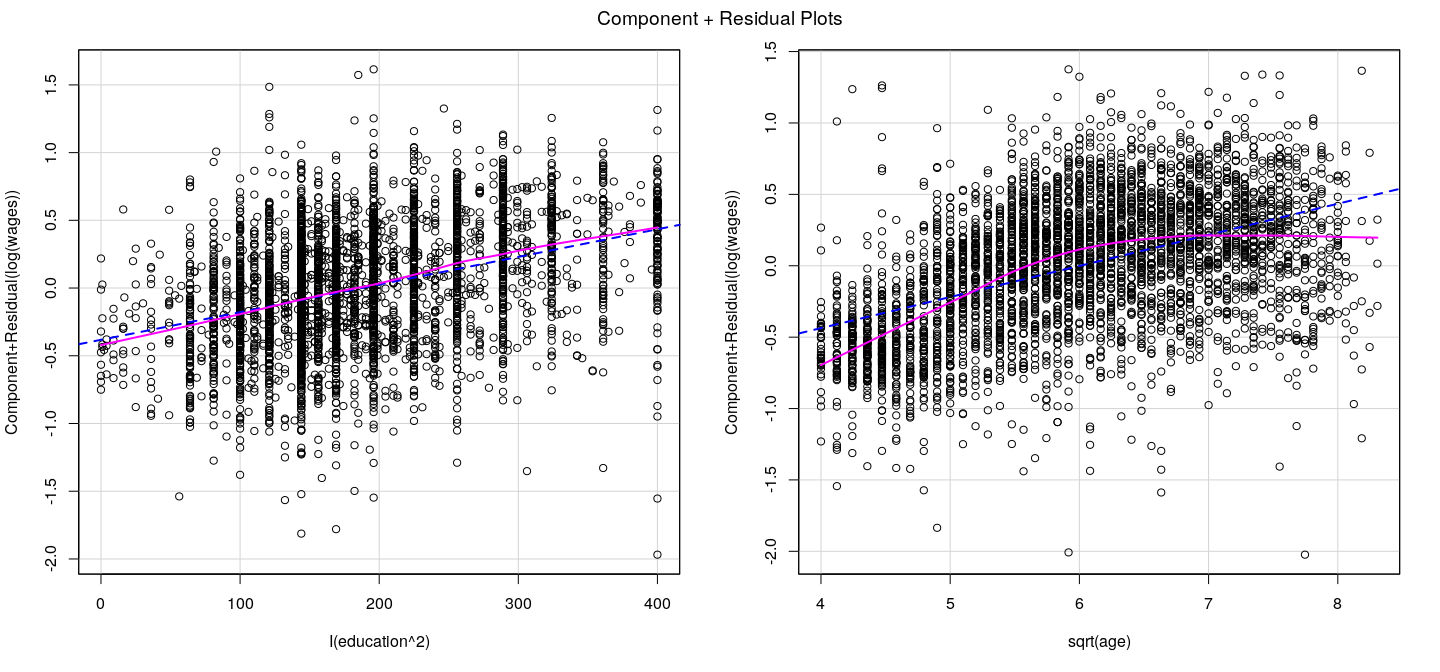

fm <- lm(log(wages) ~ I(education^2) + sqrt(age) + sex, data = SLID) # transform both age and education

crPlots(fm, ~ . - sex, layout = c(1, 2)) # all terms excluding sex

Component plus residual plots: example

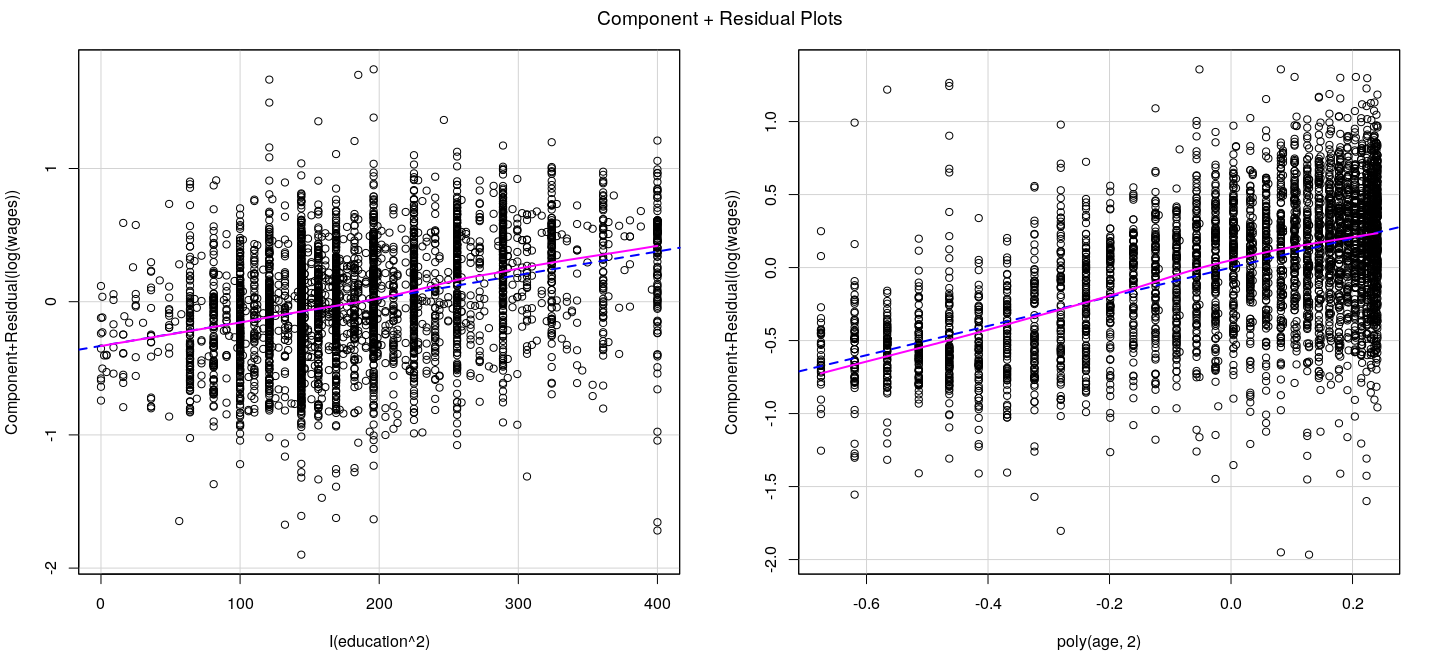

fm <- lm(log(wages) ~ I(education^2) + poly(age, 2) + sex, data = SLID) # quadratic age

crPlots(fm, ~ . - sex, layout = c(1, 2)) # multicolumn terms are handled gracefully

Component plus residual plots: caveats

Higher dimensional relationships in multiple regression models can be complicated

Component plus residual plots are two dimensional projections

May not always work: in particular, if covariates are non-linearly related

See Mallows (1986) for an approach that accounts for quadratic relationships with other covariates

See Cook (1993) for a more general approach (CERES plots)

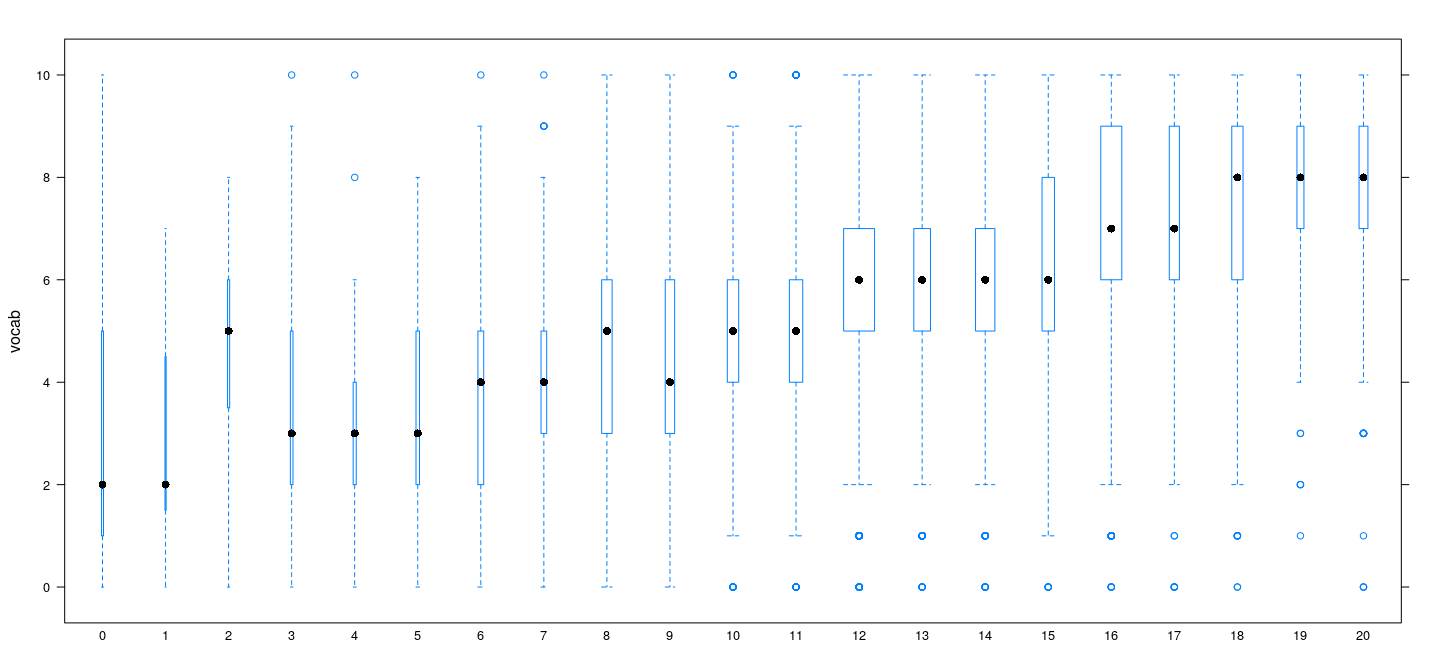

Nonlinearity for discrete predictors

As discussed earlier, discrete covariates (few unique values, many ties) allow us to fit “pure error” models

Pure error models represent a model with no restrictions on the mean function \(f(x) = E(Y | X = x)\)

Can be used to test “lack of fit” for any more specific form of \(f(x)\)

- Example:

GSSvocab(28867 observations)- Response:

vocab(Number of words out of 10 correct on a vocabulary test) - Predictors:

age(in years) andeduc(years of education)

- Response:

Example: GSSvocab data

Example: GSSvocab data

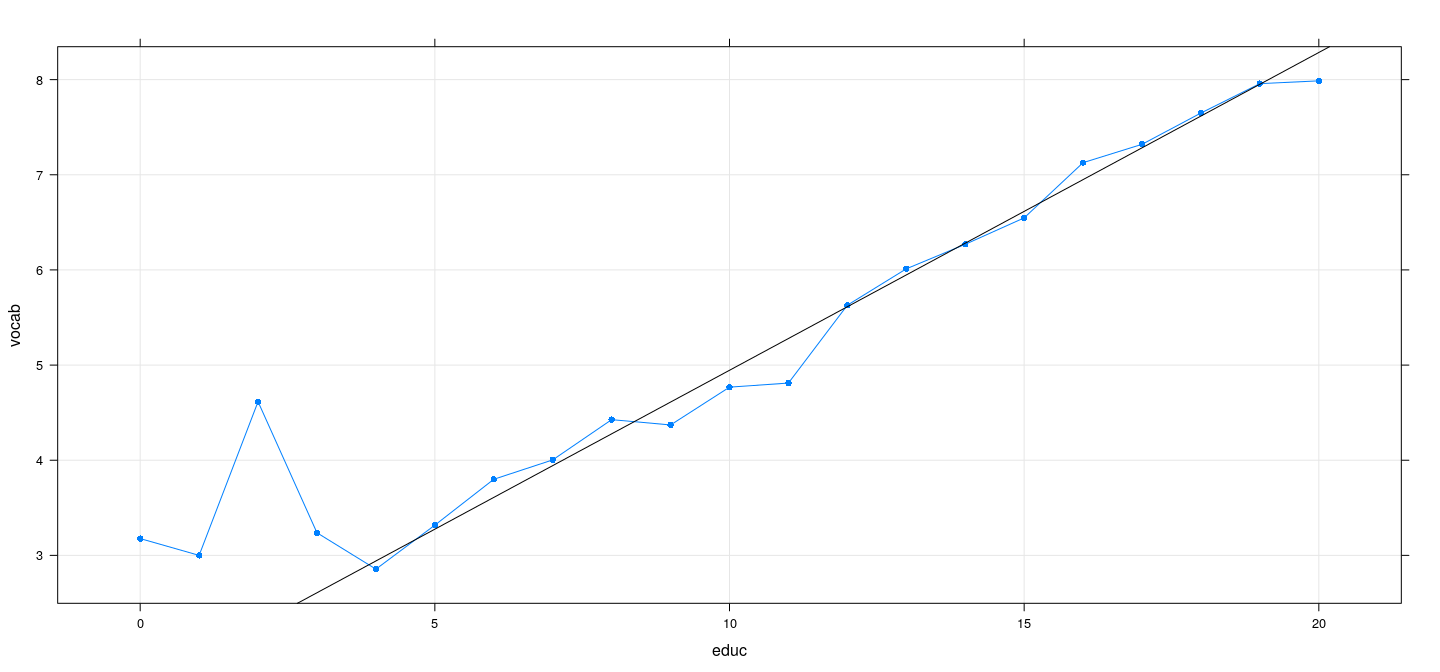

fm1 <- lm(vocab ~ educ, GSSvocab) # linear regression model

mean.vocab <- aggregate(vocab ~ educ, GSSvocab, mean)

xyplot(vocab ~ educ, mean.vocab, grid = TRUE, pch = 16, type = "o") + layer(panel.abline(fm1))

Example: GSSvocab data

Analysis of Variance Table

Model 1: vocab ~ educ

Model 2: vocab ~ factor(educ)

Res.Df RSS Df Sum of Sq F Pr(>F)

1 27471 93895

2 27452 92906 19 989.32 15.386 < 2.2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Example: GSSvocab data

- Even though there is significant lack of fit, the improvement is marginal

[1] 0.2283162[1] 0.236447

- This is a common theme

- Statistical tests are more sensitive for large \(n\)

- Statistical significance does not necessarily mean the difference (effect) is important in practice

Example: SLID data

- We can do similar tests for multiple regression models

fm1 <- lm(log(wages) ~ I(education^2) + poly(age, 2) + sex, data = SLID)

fm2 <- lm(log(wages) ~ factor(education) + poly(age, 2) + sex, data = SLID)

fm3 <- lm(log(wages) ~ I(education^2) + factor(age) + sex, data = SLID)

fm4 <- lm(log(wages) ~ factor(education) + factor(age) + sex, data = SLID)- \(R^2\) does not improve substantially

$fm1

[1] 0.384718

$fm2

[1] 0.4086884

$fm3

[1] 0.3996565

$fm4

[1] 0.423225Example: SLID data

- Formal lack of fit tests

Analysis of Variance Table

Model 1: log(wages) ~ I(education^2) + poly(age, 2) + sex

Model 2: log(wages) ~ factor(education) + factor(age) + sex

Res.Df RSS Df Sum of Sq F Pr(>F)

1 4009 626.42

2 3834 587.21 175 39.204 1.4627 9.9e-05 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Example: SLID data

Analysis of Variance Table

Model 1: log(wages) ~ factor(education) + poly(age, 2) + sex

Model 2: log(wages) ~ factor(education) + factor(age) + sex

Res.Df RSS Df Sum of Sq F Pr(>F)

1 3885 602.01

2 3834 587.21 51 14.8 1.8947 0.0001394 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Analysis of Variance Table

Model 1: log(wages) ~ I(education^2) + factor(age) + sex

Model 2: log(wages) ~ factor(education) + factor(age) + sex

Res.Df RSS Df Sum of Sq F Pr(>F)

1 3958 611.21

2 3834 587.21 124 23.995 1.2634 0.02743 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Using pure error models to test for non-constant variance

- With discrete predictors, constant variance means within-group sample variances should be similar

\[ S_j^2 = \frac{1}{n_j-1} \sum_{i=1}^{n_j} (y_{ij} - \bar{y}_j)^2, j = 1, \dotsc, k \]

- Define the pooled variance

\[ S_p^2 = \frac{1}{n-k} \sum_{j=1}^k (n_j - 1) S_j^2, \text{ where } n = \sum_{j=1}^k n_j \]

- Then Bartlett’s test statistic is (an adjustment of the likelihood ratio test statistic)

\[ T = \frac{(n-k) \log S_p^2 - \sum_{j=1}^k (n_j-1) \log S_j^2 }{1 + \frac{1}{3(k-1)} (\sum_{j=1}^k \frac{1}{n_j - 1} - \frac{1}{n-k})} \]

- Under the null distribution of constant variance, \(T\) follows a \(\chi^2\) distribution with \((k-1)\) d.f.

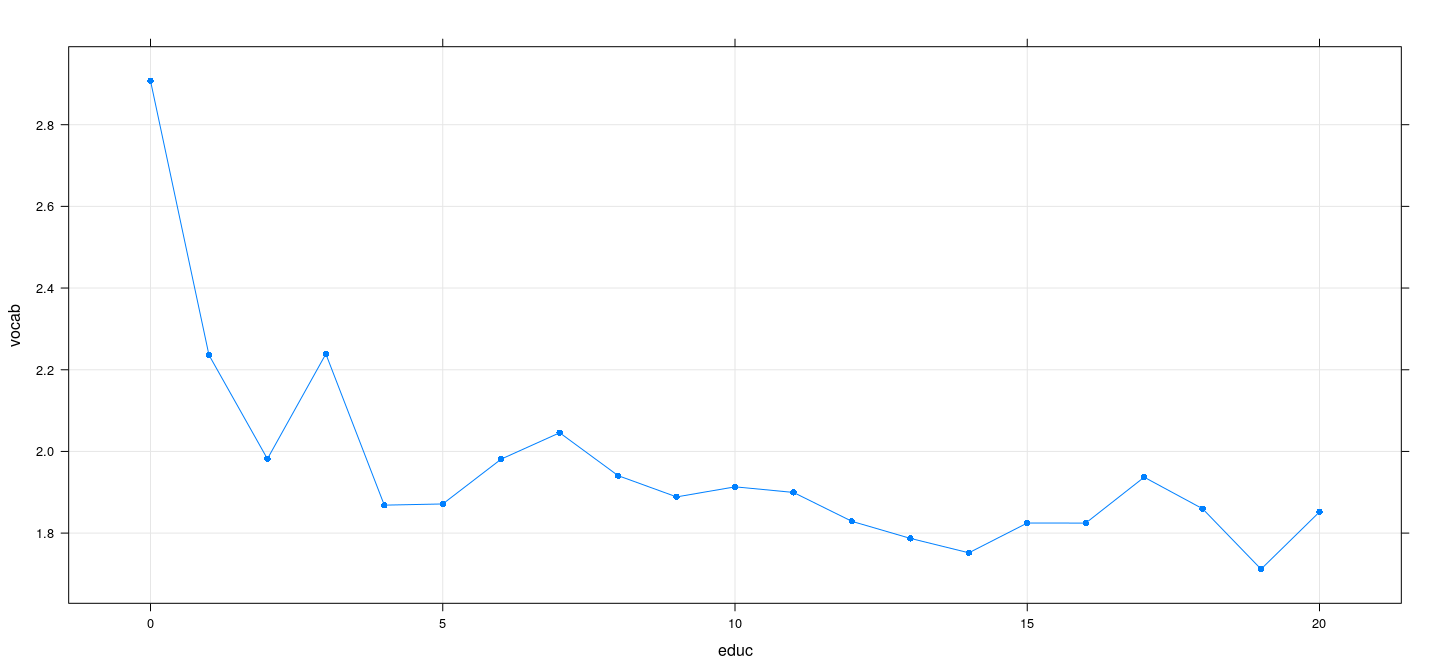

Using pure error models to test for non-constant variance

- Example:

GSSvocabdata

sd.vocab <- aggregate(vocab ~ educ, GSSvocab, sd)

xyplot(vocab ~ educ, sd.vocab, grid = TRUE, pch = 16, type = "o")

Using pure error models to test for non-constant variance

Bartlett test of homogeneity of variances

data: vocab by factor(educ)

Bartlett's K-squared = 78.606, df = 20, p-value = 6.761e-09Bartlett’s test is not robust when errors are non-normal

Levene’s test is a more robust alternative

Levene's Test for Homogeneity of Variance (center = median)

Df F value Pr(>F)

group 20 5.3673 6.42e-14 ***

27452

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1The Box-Cox transformation: a likelihood-based approach

- The Box-Cox transformation deals with non-normality, non-linearity, and non-constant variance

\[ g_\lambda(y) = \begin{cases} \frac{y^\lambda - 1}{\lambda} & \lambda \neq 0 \\ \log y & \lambda = 0 \end{cases} \]

Can we choose \(\lambda\) using a formal inference procedure?

Suppose the assumptions of the normal linear model holds for the transformed response

\[ g_\lambda(y_i) \sim N( \mathbf{x}_i^T \beta, \sigma^2), i = 1, \dotsc, n \]

- To estimate \(\lambda\) by maximizing likelihood, we need the density of the untransformed response \(\mathbf{y}\) in terms of \(\lambda\)

The Box-Cox transformation: a likelihood-based approach

- The likelihood function based on the untransformed response is

\[ \ell(\lambda, \beta, \sigma^2 \mid \mathbf{y}) = \frac{1}{(2\pi)^{n/2} \sigma^n} e^{-\frac{1}{2 \sigma^2} \lVert g_{\lambda}(\mathbf{y}) - \mathbf{X} \beta \rVert^2 } \, J(\lambda; \mathbf{y}) \]

- Here the Jacobian of the transformation is

\[ J(\lambda; \mathbf{y}) = \prod_{i=1}^n \left\lvert g_{\lambda}^{\prime}(y_i) \right\rvert, \text{ where } g_{\lambda}^{\prime}(y_i) = \frac{\mathrm{d}}{\mathrm{d} y} \left(\frac{y^\lambda - 1}{\lambda}\right) = y^{\lambda-1} \]

- This also holds for \(\lambda = 0\), as \(\frac{\mathrm{d}}{\mathrm{d} y} \log y = y^{0-1}\). So,

\[ J(\lambda; \mathbf{y}) = \prod_{i=1}^n y_i^{\lambda - 1} \]

The Box-Cox transformation: a likelihood-based approach

- For a particular choice of \(\lambda\)

- The likelihood is minimized when \(\beta\) and \(\sigma^2\) are MLEs for the model \(g_{\lambda}(\mathbf{y}) \sim N(\mathbf{X}\beta, \sigma^2 \mathbf{I})\)

- Corresponding profile log-likelihood is

\[ \log \ell(\lambda) = -\frac{n}{2} (\log 2\pi + \log \hat{\sigma}^2(\lambda) + 1) + (\lambda-1) \sum_i \log y_i \]

The global joint optimum for \((\lambda, \beta, \sigma^2)\) can be obtained by maximizing this w.r.t. \(\lambda\)

No closed-form solution, so usually solved numerically

For specific choice \(\lambda_0\), \(H_0: \lambda = \lambda_0\) can be tested using LRT (asymptotically \(\chi^2_1\))

This test can be inverted to give a confidence interval for \(\lambda\)

In practice, we choose a “simple” \(\lambda\) close to the optimum (for interpretability of the model)

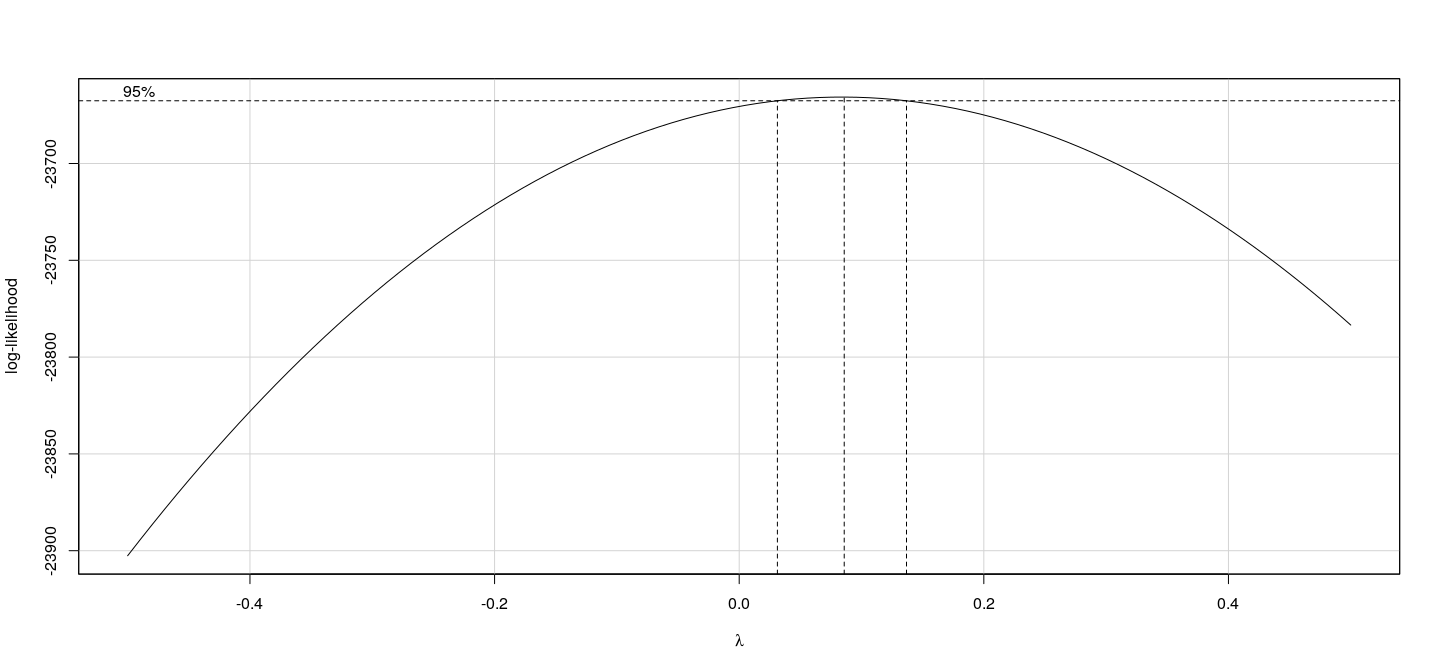

The Box-Cox transformation: example

fm <- lm(wages ~ education + age + sex, data = SLID)

boxCox(fm, lambda = seq(-0.5, 0.5, 0.1), plotit = TRUE) # log is close enough to optimum

The Box-Tidwell procedure for transforming covariates

- A similar likelihood approach can be used to estimate covariate transformations. Suppose

\[ y_i = \alpha + \sum_j \beta_j X_{ij}^{\gamma_j} + \varepsilon_i,\, \varepsilon_i \sim N(0, \sigma^2) \]

Likelihood is simpler as response is not transformed, but potentially large number of parameters

No closed-form solution

Box and Tidwell (1962) suggest an iterative procedure to obtain MLEs

Linear approximation of the model:

\[ y_i = \alpha + \sum_j \beta^\prime_j X_{ij} + \delta_j X_{ij} \log X_{ij} + \varepsilon_i,\, \varepsilon_i \sim N(0, \sigma^2) \]

- This follows from the First-order Taylor series approximation

\[ x^\gamma \approx x + (\gamma-1) x \log x \]

The Box-Tidwell procedure for transforming covariates

Iterative procedure

Regress \(y_i\) on \(X_{ij}\) to obtain \(\hat{\beta}_j\)

Regress \(y_i\) on \(X_{ij}\) and \(\log X_{ij}\) to obtain \(\hat{\beta}^\prime_j\) and \(\hat{\delta}_j\)

Test \(H_0: \delta_j = 0\) to assess need for transformation

Preliminary estimate \(\tilde{\gamma}_j = 1 + \frac{\hat{\delta}_j}{\hat{\beta}_j}\) (Note: not \(\hat{\beta}^\prime_j\))

Transform \(X_{ij} \mapsto X_{ij}^{\tilde{\gamma}_j}\) and iterate until estimates stabilize

Exercise: If MLE \(\hat{\gamma}_j = 1\), model fit should give \(\hat{\delta}_j = 0\)

The Box-Tidwell procedure: example

MLE of lambda Score Statistic (z) Pr(>|z|)

I(0.01 + education) 1.8696 4.396 1.103e-05 ***

age -1.6301 -21.772 < 2.2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

iterations = 9